Streamlining your financial management has never been simpler with the TD Bank app. This advanced mobile banking platform empowers users to access their accounts with unparalleled convenience, wherever they may be. Whether you're monitoring your balance, executing fund transfers, or depositing checks, the TD Bank app transforms these tasks into seamless experiences with just a few taps on your smartphone. Thoughtfully designed with a focus on user experience, this app delivers security, intuitiveness, and a suite of features tailored to meet today's banking demands.

As the landscape of digital banking continues to evolve, the TD Bank app emerges as a dependable solution for individuals seeking flexibility in handling their finances. With features such as instant transaction notifications and personalized financial insights, the app ensures that you maintain full control over your monetary activities. Its user-friendly design and stringent security protocols have positioned it as a preferred option for TD Bank customers who wish to bank on their own terms. Regardless of whether you're a tech-savvy millennial or new to mobile banking, the TD Bank app is crafted to enhance your financial management journey.

With millions of downloads and consistently high ratings, the TD Bank app has cemented its reputation as a trusted companion for daily banking needs. Its flawless integration with TD Bank’s online banking platform ensures that all your financial data remains synchronized across multiple devices. Beyond standard banking functionalities, the app offers tools designed to assist you in saving smarter, spending more wisely, and planning for the future. This guide will delve into everything you need to know about the TD Bank app, from its distinguished features to strategies for maximizing its utility.

Read also:Understanding Electrical Plugs And Voltage In Costa Rica A Travelers Guide

Table of Contents

- Why the TD Bank App Excels

- Starting Your Journey with the TD Bank App

- Ensuring Security with the TD Bank App

- Key Features of the TD Bank App

- How the TD Bank App Helps You Save

- Why Use the TD Bank App for Budgeting

- Troubleshooting Common App Issues

- Frequently Asked Questions

Why the TD Bank App Excels

In today's fast-paced world, having a reliable mobile banking app is indispensable. The TD Bank app distinguishes itself from competitors through a combination of convenience, security, and innovation. One of its most notable attributes is its ability to offer users a comprehensive overview of their financial health. Through intuitive dashboards, customers can effortlessly track their spending patterns, monitor account balances, and review transaction histories—all consolidated in one convenient location.

Another distinguishing feature of the TD Bank app is its dedication to accessibility. Available on both iOS and Android platforms, the app ensures that users can access their accounts irrespective of their preferred operating system. Moreover, TD Bank has prioritized inclusivity by integrating features such as voice commands and screen reader compatibility for visually impaired users. This commitment to accessibility aligns with TD Bank’s mission to make banking universally accessible.

Furthermore, the TD Bank app is designed to save users time. Features like Zelle integration for immediate peer-to-peer payments and customizable reminders for bill due dates eliminate the need for manual follow-ups. Whether you're paying bills, transferring funds to family, or depositing checks, the app simplifies these tasks with minimal effort. By blending cutting-edge technology with user-focused design, the TD Bank app has secured its position as a leader in the mobile banking domain.

Starting Your Journey with the TD Bank App

Initiating your journey with the TD Bank app is a simple and straightforward process. Begin by ensuring that your smartphone meets the app's system requirements, which are clearly detailed on TD Bank’s official website. Once verified, navigate to the Apple App Store or Google Play Store and search for “TD Bank app.” Download and install the app, which is available at no cost. After installation, launch the app and follow the on-screen instructions to log in using your existing TD Bank online banking credentials.

If you're new to TD Bank, you'll need to establish an account before accessing the app. Visit TD Bank’s website or visit a local branch to open an account, and during the setup process, you'll receive login credentials. Once your account is active, you can connect it to the TD Bank app. For enhanced security, the app requires multi-factor authentication, such as fingerprint scanning, facial recognition, or a unique PIN, to confirm your identity each time you log in.

To fully leverage the TD Bank app, take some time to explore its settings. Customize notification preferences to stay updated on account activity, set up automatic bill payments, and link external accounts for effortless transfers. Additionally, acquaint yourself with the app's help section, which provides comprehensive guides and FAQs to address any queries you may have. With a bit of practice, you'll soon become adept at navigating the app's features.

Read also:Exploring The Wild World Of Florida Man Unusual Tales And Cultural Impact

Ensuring Security with the TD Bank App

Security is a top priority for TD Bank, and the TD Bank app reflects this commitment through its advanced protective mechanisms. The app utilizes industry-leading encryption protocols to safeguard your personal and financial information. Every transaction and communication between your device and TD Bank’s servers is encrypted, ensuring that your data remains confidential and secure.

Beyond encryption, the TD Bank app incorporates multiple layers of authentication to deter unauthorized access. Features such as biometric login (fingerprint or facial recognition) add an extra layer of security, while push notifications alert you to any suspicious activity. TD Bank also provides tools like account lockout options and the ability to remotely disable access if your phone is misplaced or stolen.

For additional reassurance, TD Bank actively monitors accounts for potential fraud and sends real-time alerts if unusual activity is detected. Customers can also enable two-factor authentication for an added layer of protection. By integrating cutting-edge technology with proactive fraud prevention measures, the TD Bank app ensures that your financial information remains secure while delivering a seamless user experience.

Key Features of the TD Bank App

The TD Bank app is equipped with a range of features designed to simplify your banking experience. Below, we'll explore some of its most noteworthy functionalities that make it an indispensable tool for managing your finances.

Effortless Mobile Check Deposits

Among the most convenient features of the TD Bank app is its mobile check deposit capability. This feature enables you to deposit checks directly into your account using your smartphone's camera. Simply open the app, navigate to the “Deposit” section, and follow the prompts to capture images of the front and back of your check. Once submitted, TD Bank processes the deposit swiftly, often crediting your account within one business day.

Mobile check deposit not only eliminates the need for a trip to the bank but also removes the necessity of mailing checks or utilizing ATMs. To ensure accuracy, the app provides guidelines for capturing clear images, such as proper lighting and alignment. Additionally, TD Bank imposes daily and monthly deposit limits to prevent misuse, ensuring the feature remains secure and reliable.

Real-Time Alerts

Staying informed about your account activity is crucial for effective financial management. The TD Bank app offers real-time notifications that alert you to important updates, such as deposits, withdrawals, and pending transactions. These notifications can be customized to align with your preferences, ensuring you receive only the information that matters most to you.

For instance, you can set up alerts for low balances, upcoming bill payments, or transactions exceeding a specified amount. These proactive notifications help you avoid overdraft fees, missed payments, and unauthorized charges. By keeping you informed in real-time, the TD Bank app empowers you to take prompt action whenever necessary.

How the TD Bank App Helps You Save

The TD Bank app isn't just about convenience—it's also a potent tool for helping you save money. One of its standout features is the ability to set up automatic savings transfers. By scheduling recurring transfers from your checking account to a savings account, you can effortlessly build your savings over time without needing to think about it.

Additionally, the app provides insights into your spending habits, helping you pinpoint areas where you can reduce expenses. Through detailed transaction histories and categorized spending reports, you can see exactly where your money is going each month. This visibility enables you to make informed decisions about your budget and prioritize saving for future goals.

For those aiming to maximize their savings, the TD Bank app integrates with TD Bank’s high-yield savings accounts and CDs. By linking these accounts to the app, you can monitor interest earnings and adjust your contributions as needed. With these tools at your disposal, the TD Bank app makes it easier than ever to achieve your financial aspirations.

Why Use the TD Bank App for Budgeting

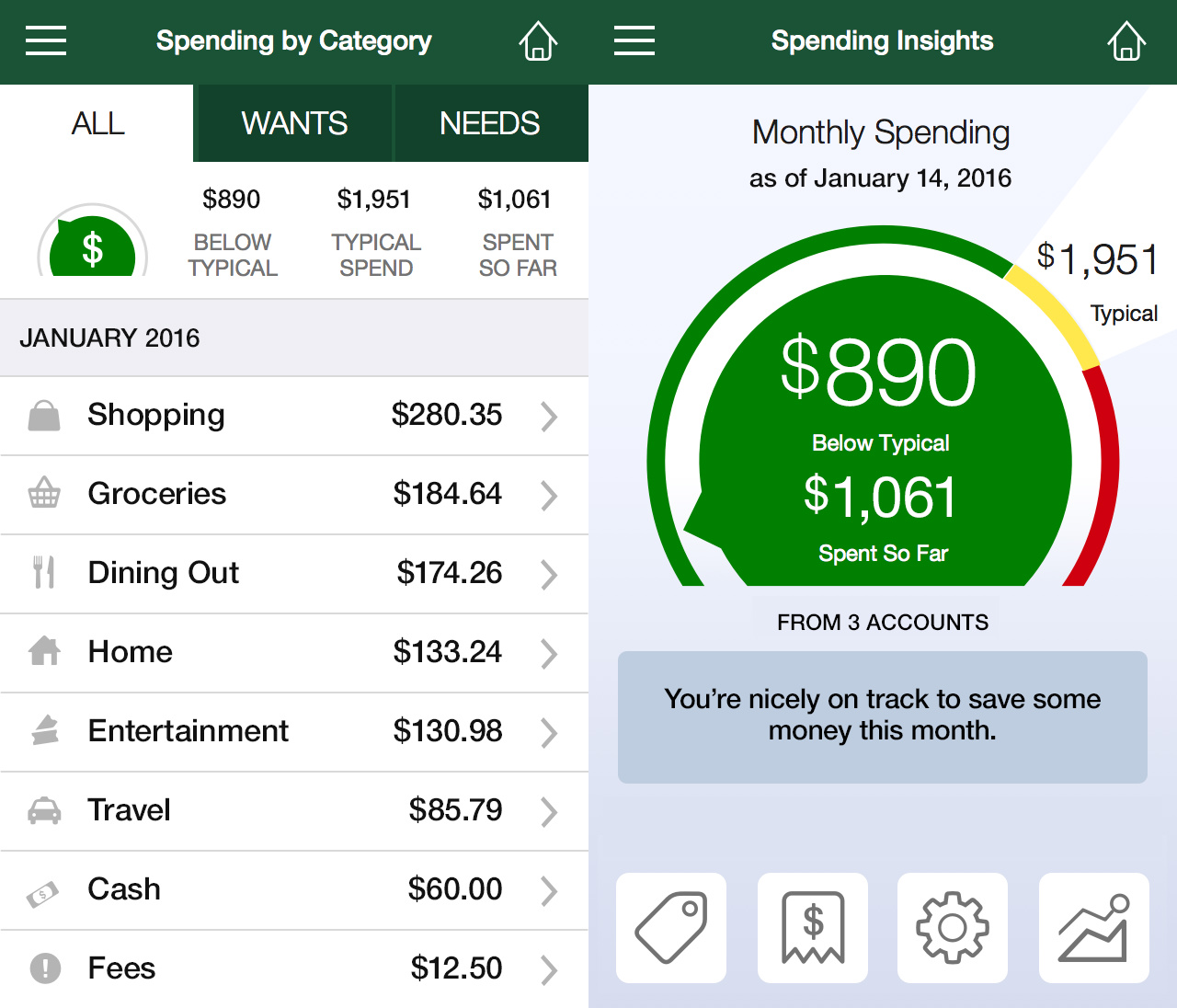

Budgeting is a cornerstone of financial well-being, and the TD Bank app is equipped with tools to assist you in creating and adhering to a budget. Its intuitive interface allows you to categorize expenses, set spending limits, and track your progress in real-time. By visualizing your financial data through charts and graphs, the app makes it easier to comprehend your spending patterns and identify areas for improvement.

Another advantage of using the TD Bank app for budgeting is its ability to sync with external accounts. Whether you have accounts at other banks or credit cards from different providers, you can link them to the app for a comprehensive view of your finances. This holistic perspective ensures that you're accounting for all income and expenses when formulating your budget.

Finally, the app's customizable alerts play a pivotal role in maintaining your budget on track. For example, you can set up notifications when you're nearing your spending limit in a particular category or when a bill is due. These reminders help you stay disciplined and avoid overspending, making the TD Bank app an indispensable tool for anyone serious about managing their money.

Troubleshooting Common App Issues

While the TD Bank app is designed to be user-friendly, occasional issues may arise. Here are some common problems and how to resolve them:

- Login Issues: If you're unable to log in, double-check your credentials and ensure that your internet connection is stable. If the problem persists, reset your password using the app’s “Forgot Password” feature.

- Slow Performance: A slow app may be caused by outdated software. Ensure your app and device operating system are up to date. Clearing the app’s cache can also enhance performance.

- Transaction Errors: If a transaction doesn't go through, verify that you have sufficient funds and that your account details are accurate. Contact TD Bank customer support if the issue isn't resolved.

- Notification Delays: If you're not receiving notifications, check your app settings to ensure alerts are enabled. Also, confirm that your phone’s notification settings allow messages from the TD Bank app.

If none of these solutions work, TD Bank offers 24/7 customer support via phone, chat, or email. Their knowledgeable representatives can assist with more complex issues and ensure your app experience remains smooth and hassle-free.

Frequently Asked Questions

Here are answers to some of the most common questions users have about the TD Bank app:

Can I Use the TD Bank App Without an Internet Connection?

No, the TD Bank app requires an active internet connection to function properly. However, you can still view certain cached information, such as your account balance, if you've recently accessed the app while online.

Is There a Fee for Using the TD Bank App?

No, the TD Bank app is free to download and use. However, standard data rates from your mobile carrier may apply when using the app.

How Do I Contact TD Bank Support Through the App?

You can contact TD Bank support directly through the app by navigating to the “Help” section. From there, you'll find options to call, chat, or email customer service representatives.

Conclusion

The TD Bank app transcends the role of a mere mobile banking tool—it's a comprehensive solution for managing your finances with ease and confidence. From its robust security measures to its innovative features, the app caters to the