The concept of biz buy sell transcends mere transactions—it represents a transformative milestone for both buyers and sellers. For sellers, it symbolizes the culmination of years of dedication and effort, while for buyers, it signifies the dawn of a new chapter brimming with opportunities. In today’s rapidly evolving business landscape, grasping the intricacies of this process is essential. From pinpointing the ideal business to ensuring a fair valuation, every phase of the biz buy sell journey demands meticulous planning and execution. This guide will navigate you through the entire process, offering valuable insights, practical tips, and proven strategies to help you succeed. As we delve deeper into the topic, you'll uncover the critical elements that contribute to successful biz buy sell transactions. We'll explore how to identify the right opportunities, the significance of conducting thorough due diligence, and how to negotiate effectively. Furthermore, we'll tackle common challenges and provide actionable solutions to help you sidestep potential pitfalls. By the conclusion of this article, you'll possess a thorough understanding of the biz buy sell landscape, empowering you to make well-informed decisions and achieve your business aspirations.

Table of Contents

- Understanding Biz Buy Sell and Its Importance

- How to Identify the Ideal Business for Sale?

- Why Due Diligence is Essential in Biz Buy Sell?

- Analyzing Business Financials: Metrics That Matter

- Negotiating Effectively: Strategies for Success

- Common Challenges in Biz Buy Sell and How to Overcome Them

- Ensuring a Smooth Transition Post-Sale

- Frequently Asked Questions About Biz Buy Sell

Understanding Biz Buy Sell and Its Importance

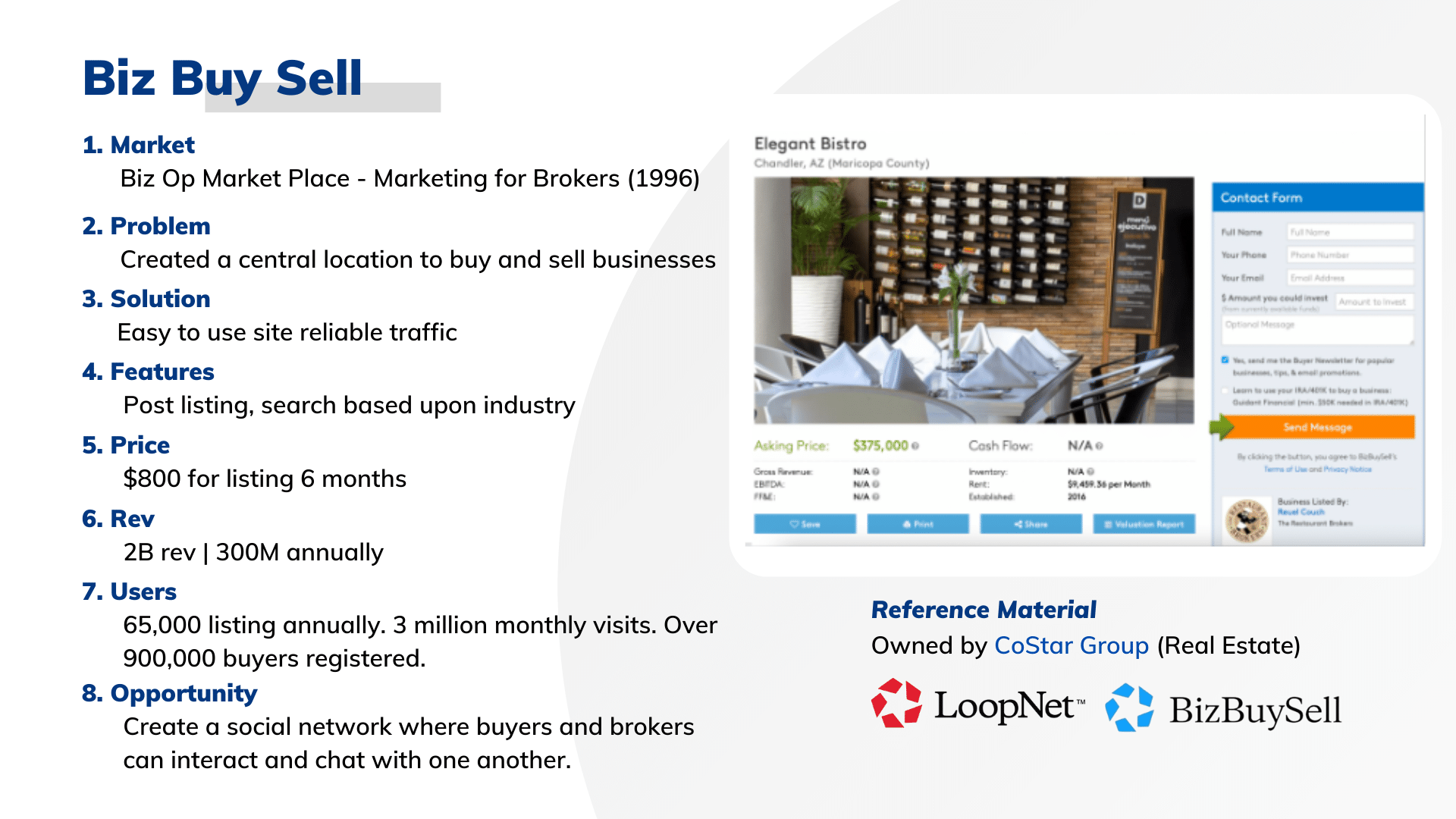

The term "biz buy sell" encapsulates the comprehensive process of purchasing or selling a business. This multifaceted journey encompasses various stages, from identifying opportunities to finalizing the transaction. At its core, biz buy sell revolves around creating value—whether you're a seller aiming to maximize returns or a buyer seeking to acquire a profitable venture. Grasping this process is vital for anyone intent on navigating the business marketplace successfully. In today’s highly competitive environment, the biz buy sell industry has experienced significant growth, with dedicated platforms and marketplaces connecting buyers and sellers. These platforms offer a wealth of resources, including listings, valuation tools, and expert advice. For sellers, these resources facilitate showcasing their business to a global audience, while buyers benefit from accessing a wide array of opportunities. The significance of biz buy sell extends beyond individual transactions—it plays a crucial role in promoting economic growth and fostering innovation. A key reason why biz buy sell matters lies in its potential to unlock hidden value. For sellers, it provides an avenue to monetize years of effort and investment, while buyers can leverage existing infrastructure and customer bases to accelerate their growth. Regardless of whether you're an experienced entrepreneur or a first-time buyer, understanding the dynamics of biz buy sell can empower you to make well-informed decisions and achieve your business objectives.

How to Identify the Ideal Business for Sale?

Finding the perfect business for sale marks the initial step in the biz buy sell journey. Given the multitude of opportunities available, it's imperative to refine your search based on your goals, expertise, and financial capacity. Begin by pinpointing industries that align with your interests and skills. For example, if you have a background in retail, you might wish to explore businesses within that sector. Similarly, consider the size of the business, its location, and its growth prospects. Once you've identified your target market, utilize online platforms and marketplaces dedicated to biz buy sell. These platforms furnish detailed listings, including financial data, operational insights, and seller motivations. Furthermore, networking plays a crucial role in discovering the right opportunity. Attend industry events, engage in business forums, and connect with brokers specializing in biz buy sell transactions. Their expertise can assist you in uncovering hidden gems that may not be publicly listed. An additional effective strategy involves evaluating the competition. Research businesses currently for sale and analyze their strengths and weaknesses. This will not only assist you in identifying potential acquisition targets but also enhance your understanding of market trends. By combining thorough research with strategic networking, you can enhance your chances of finding the ideal business for sale.

Read also:The Ultimate Guide To Cooking Shrimp To Perfection

Key Factors to Consider When Assessing Opportunities

When evaluating potential businesses for sale, several critical factors warrant consideration:

- Industry Trends: Is the industry experiencing growth, or is it encountering challenges?

- Financial Performance: Review revenue, profit margins, and cash flow to assess stability.

- Customer Base: Evaluate the loyalty and diversity of the customer base to gauge long-term potential.

- Operational Efficiency: Examine the business’s processes and systems to ensure they are optimized for success.

- Location: Consider the geographic advantages or disadvantages that may impact the business's performance.

Why Due Diligence is Essential in Biz Buy Sell?

Due diligence serves as the foundation of any successful biz buy sell transaction. It entails a thorough examination of the business's financials, legal standing, operations, and market position. This process ensures that buyers gain a clear understanding of what they're acquiring and assists sellers in presenting their business in the best possible light. Neglecting due diligence can result in costly mistakes, making it an indispensable step in the biz buy sell journey. The initial phase of due diligence involves reviewing the business's financial statements. This includes scrutinizing income statements, balance sheets, and cash flow statements. Look for inconsistencies, such as declining revenues or rising debt, which may indicate underlying issues. Additionally, verify the accuracy of the financial data by cross-referencing it with tax returns and other official documents. Legal due diligence is equally important. Confirm that the business complies with all relevant regulations and has no pending lawsuits or liabilities. Review contracts with suppliers, customers, and employees to identify any potential risks. By conducting comprehensive due diligence, you can mitigate risks and make informed decisions throughout your biz buy sell transaction.

Common Red Flags to Watch Out For

During the due diligence process, remain vigilant for these red flags:

- Inconsistent Financial Records: Discrepancies in financial statements may hint at potential fraud.

- Unclear Ownership Structure: Ensure the seller possesses the legal authority to sell the business.

- Pending Legal Issues: Lawsuits or regulatory violations can complicate the transaction process.

- Overdependence on a Single Customer: This poses a significant risk to future revenue stability.

- Outdated Technology: Businesses with outdated systems may necessitate costly upgrades to remain competitive.

Analyzing Business Financials: Metrics That Matter

One of the most crucial aspects of the biz buy sell process involves evaluating the financial health of the business. This necessitates analyzing key metrics that offer insights into its performance and sustainability. Begin by examining revenue trends over the past few years. Consistent growth serves as a positive indicator, while declining revenues may warrant further investigation. Profit margins constitute another vital metric to consider. High-profit margins suggest that the business effectively manages its costs, whereas low margins could indicate inefficiencies or pricing challenges. Additionally, assess the business's cash flow to ensure it maintains sufficient liquidity to meet its obligations. A robust cash flow is essential for sustaining operations and funding growth initiatives. Other metrics to evaluate include the debt-to-equity ratio, customer acquisition costs, and inventory turnover. These metrics provide a comprehensive view of the business's financial position and aid in determining its valuation. By meticulously analyzing these factors, you can make an informed decision and negotiate effectively during your biz buy sell transaction.

Negotiating Effectively: Strategies for Success

Negotiating the best deal represents a critical step in the biz buy sell process. It demands a blend of preparation, strategy, and communication skills. Begin by comprehending the seller's motivations. Are they looking to retire, or are they selling due to financial pressures? This understanding can provide leverage during negotiations. Next, focus on building a rapport with the seller. Establishing a positive relationship fosters a more collaborative negotiation environment. Be transparent about your intentions and demonstrate your commitment to the transaction. Additionally, be prepared to walk away if the terms don't align with your goals. This demonstrates to the seller that you're serious and willing to explore alternative opportunities. When negotiating, aim to create a win-win situation. This could involve structuring the payment terms to benefit both parties or including contingencies that safeguard your interests. By approaching negotiations with a strategic mindset, you can secure a favorable deal in your biz buy sell transaction.

Common Negotiation Tactics to Avoid

While negotiating, be cautious of these common tactics that can undermine the process:

Read also:Mastering Electrical Safety A Comprehensive Guide To Testing Live Wires

- Lowball Offers: Starting with an unreasonably low offer can erode trust.

- Overemphasis on Minor Issues: Focus on the overarching goals rather than minor details.

- Emotional Decision-Making: Base your decisions on data rather than emotions.

- Rushing the Process: Take the time necessary to ensure all details are thoroughly covered.

- Ignoring Seller Concerns: Addressing their needs can lead to a smoother negotiation process.

Common Challenges in Biz Buy Sell and How to Overcome Them

The biz buy sell process is not devoid of challenges. One of the most prevalent issues is valuation disagreements. Sellers often have an emotional attachment to their business, leading to inflated price expectations. To address this, rely on objective valuation methods, such as discounted cash flow analysis or comparable sales data. Another challenge involves financing the purchase. Many buyers struggle to secure the necessary funds, especially for larger transactions. To tackle this, explore various financing options, such as bank loans, seller financing, or partnerships. Additionally, ensure you have a solid business plan to present to lenders, demonstrating the viability of the acquisition. Lastly, cultural and operational differences can pose challenges during the transition phase. To mitigate this, involve key employees in the process and maintain open communication with stakeholders. By addressing these challenges proactively, you can ensure a successful biz buy sell transaction.

Ensuring a Smooth Transition Post-Sale

The transition phase constitutes a critical component of the biz buy sell process. A seamless transition ensures that the business continues to operate effectively and maintains its value. Begin by crafting a detailed transition plan that outlines key milestones and responsibilities. This plan should encompass timelines, resource allocation, and communication strategies. Engage with key stakeholders, including employees, customers, and suppliers, to ensure a smooth handover. Provide training and support to employees to assist them in adapting to any changes. Additionally, maintain open lines of communication with customers to reassure them of business continuity. By prioritizing the transition phase, you can maximize the value of your biz buy sell transaction.

Steps to Create an Effective Transition Plan

To create an effective transition plan, adhere to these steps:

- Identify Key Objectives: Define what you aim to achieve during the transition.

- Assign Responsibilities: Delegate tasks to ensure accountability among team members.

- Set Timelines: Establish deadlines for each phase of the transition to maintain momentum.

- Monitor Progress: Regularly review the plan and make necessary adjustments to stay on track.

- Evaluate Outcomes: Assess the success of the transition and identify areas for improvement to refine future processes.

Frequently Asked Questions About Biz Buy Sell

What Are the Key Steps in the Biz Buy Sell Process?

The biz buy sell process typically involves identifying opportunities, conducting thorough due diligence, negotiating terms, and finalizing the transaction. Each step requires careful planning and execution to ensure success.

How Can I Determine the Value of a Business?

To determine the value of a business, employ methods such as