State Farm car insurance stands out as one of the most dependable options for drivers in the United States. Boasting an extensive network of agents and a legacy of exceptional customer service, State Farm has earned its place as a trusted leader in the insurance industry. From liability coverage to collision and comprehensive plans, State Farm offers a diverse selection of policies designed to cater to the unique needs of every driver.

Selecting the ideal car insurance policy can be a daunting task, particularly when faced with numerous choices and technical terminology. However, gaining a deeper understanding of State Farm's car insurance offerings can empower you to make a well-informed decision. Whether you're exploring basic liability coverage or advanced protection plans, State Farm is committed to safeguarding both your vehicle and financial stability.

Whether you're a new driver or a seasoned one, this article aims to provide an in-depth examination of State Farm car coverage. We'll delve into the various types of coverage, their benefits, customization options, and additional considerations to help you choose the best policy tailored to your specific needs. Let's get started!

Read also:Exploring Desi Junction Vegamovies A Comprehensive Guide To Legal Streaming

Table of Contents

- Introduction to State Farm Car Coverage

- Types of State Farm Car Coverage

- Benefits of Choosing State Farm

- Policy Customization Options

- Discounts Available with State Farm

- State Farm Claims Process

- State Farm Customer Service

- Cost Considerations for State Farm Policies

- Frequently Asked Questions about State Farm Car Coverage

- Conclusion and Call to Action

Understanding State Farm Car Coverage

State Farm ranks among the largest automobile insurance providers in the United States. With over eight decades of experience, the company has cultivated a robust reputation for reliability and customer satisfaction. State Farm car coverage encompasses a wide array of plans crafted to shield drivers from unforeseen events on the road, ensuring peace of mind and financial protection.

Why State Farm Is the Right Choice

In the realm of car insurance, trust is essential. State Farm has solidified its position as a leader in the insurance sector by consistently providing high-quality services and innovative solutions. The company's unwavering dedication to customer care and financial security makes it an excellent choice for drivers of all demographics and backgrounds.

Exploring Types of State Farm Car Coverage

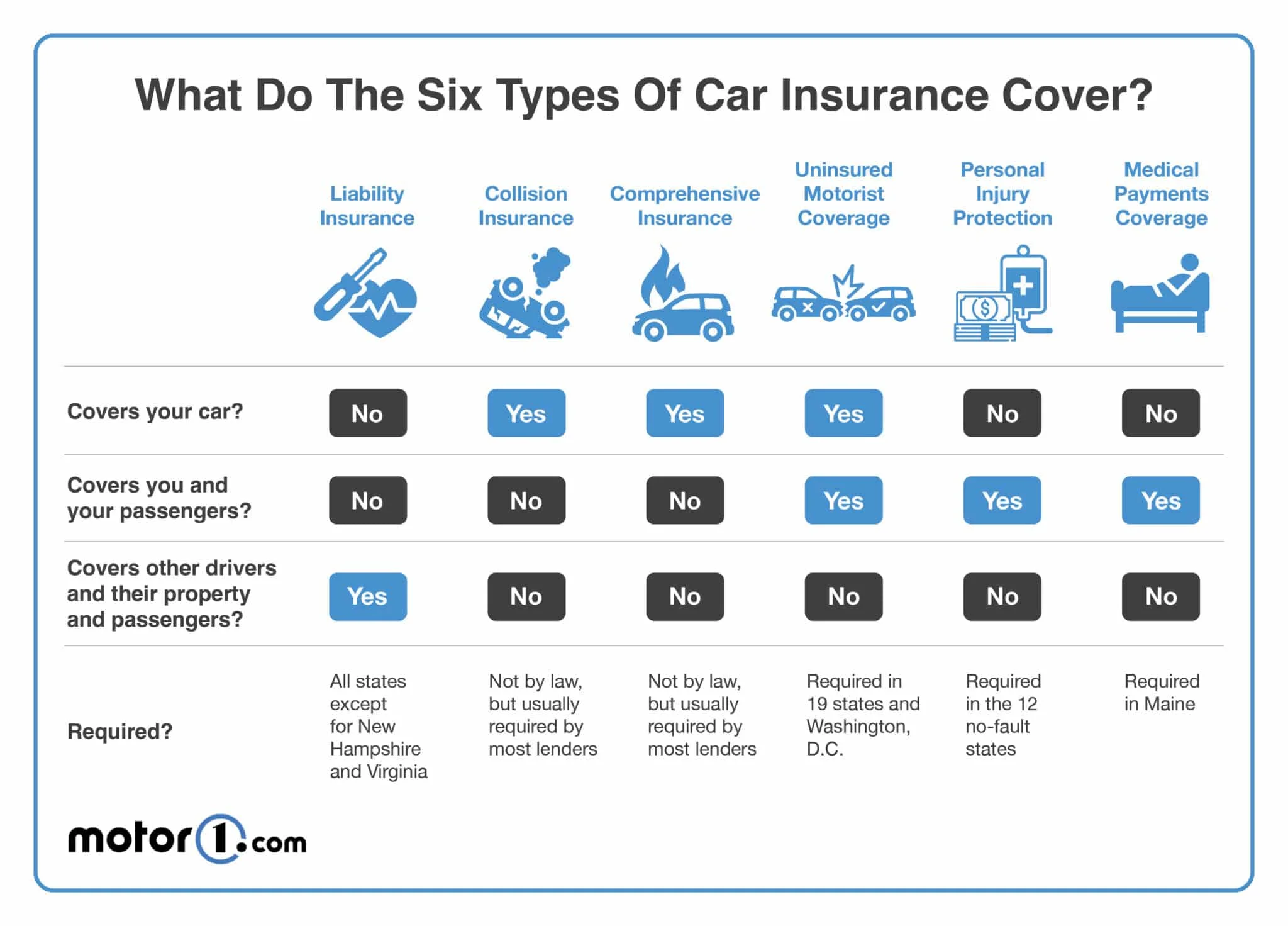

State Farm provides several distinct types of car insurance coverage to address the diverse requirements of its clientele. A thorough comprehension of these options is essential for selecting a policy that aligns with your vehicle and driving habits.

Liability Coverage

Liability coverage is a legal requirement in the majority of states. It shields you from financial responsibility in the event of an accident where you are deemed at fault. State Farm's liability coverage encompasses:

- Bodily injury liability: This covers medical expenses incurred by others due to injuries caused in an accident.

- Property damage liability: This covers damages to another person's property resulting from an accident.

Collision Coverage

Collision coverage compensates for repairs or replacement of your vehicle if it sustains damage in an accident involving another vehicle or object. This coverage is especially beneficial for newer or more costly vehicles, offering added peace of mind.

Comprehensive Coverage

Comprehensive coverage safeguards against non-collision-related damages, such as theft, vandalism, or natural disasters. It serves as a crucial supplement to any car insurance policy, providing comprehensive protection for your vehicle.

Read also:Cyberpunk 2077 Delamains Dont Lose Your Mind Mission Unveiled

Advantages of Choosing State Farm

State Farm distinguishes itself from competitors through several notable advantages:

- An expansive network of agents ensures personalized service tailored to your unique needs.

- 24/7 customer support is available for emergencies and inquiries, ensuring you're never left without assistance.

- Competitive pricing and flexible payment options make it easier to find a plan that fits your budget.

Customizing Your State Farm Policy

State Farm acknowledges that every driver has distinct needs. To accommodate this, they offer customizable policies that allow you to tailor your coverage to suit your lifestyle. Customization options include:

- Roadside assistance for added peace of mind, ensuring you're prepared for unexpected situations.

- Rental car reimbursement in the event of an accident, allowing you to maintain your daily routine without disruption.

- Gap insurance for leased or financed vehicles, bridging the gap between the value of your vehicle and the amount owed in case of a total loss.

Available Discounts with State Farm

State Farm provides a variety of discounts designed to help you save on your car insurance premiums. Some of these include:

- Safe driver discounts for maintaining a spotless driving record, rewarding responsible driving habits.

- Multivehicle discounts for insuring multiple vehicles under a single policy, offering convenience and cost savings.

- Good student discounts for young drivers who excel academically, encouraging both academic achievement and safe driving.

Navigating the State Farm Claims Process

Filing a claim with State Farm is a streamlined and efficient process. Their dedicated claims team works diligently to resolve your issues and provide the necessary support. Here's an overview of how the claims process works:

- Contact State Farm immediately following an accident to initiate the claims process.

- Provide all pertinent details and documentation to ensure a thorough investigation.

- Receive a settlement offer based on a comprehensive assessment of the damages incurred.

Exceptional Customer Service at State Farm

State Farm is celebrated for its outstanding customer service. Their agents are extensively trained to address any questions or concerns you may have regarding your policy. Whether you need to adjust your coverage or file a claim, State Farm's customer service team is always available to assist you promptly and effectively.

Factors Influencing State Farm Policy Costs

The cost of your State Farm car coverage is influenced by several factors, including:

- Your driving history and record, which play a significant role in determining your risk profile.

- The type and age of your vehicle, as newer or more expensive vehicles may require higher coverage limits.

- The level of coverage you choose, allowing you to balance cost and protection according to your preferences.

Collaborating closely with a State Farm agent enables you to identify a policy that aligns with both your budgetary constraints and your specific needs.

Frequently Asked Questions About State Farm Car Coverage

Below are some commonly asked questions and their corresponding answers regarding State Farm car coverage:

Q: Is State Farm car insurance affordable?

A: Yes, State Farm offers competitive pricing and flexible payment plans to accommodate a wide range of budgets, ensuring accessibility for all drivers.

Q: How long does it take to process a claim?

A: The processing time varies depending on the complexity of the claim. However, State Farm strives to resolve claims swiftly and efficiently, minimizing delays and inconvenience.

Conclusion and Call to Action

State Farm car coverage delivers comprehensive protection and unwavering peace of mind for drivers throughout the United States. With an extensive array of coverage options, customizable policies, and exceptional customer service, State Farm remains a premier choice for those seeking reliable car insurance.

We encourage you to further explore State Farm's offerings and consult with a local agent to identify the policy best suited to your unique needs. Additionally, feel free to leave a comment below or share this article with others who may benefit from its insights. Thank you for reading!

For more information on State Farm car coverage, visit their official website or contact a licensed agent in your area. Sources: State Farm Official Website, Insurance Information Institute.