Are you considering whether it’s possible to use your credit card for your monthly car payment? Many individuals are exploring this option to earn rewards, optimize cash flow, or take advantage of credit card benefits. However, the answer isn’t as simple as a definitive "yes" or "no." This article will serve as a comprehensive guide to help you navigate the complexities of using a credit card for car payments.

In today’s financial environment, utilizing credit cards for various expenses has grown in popularity. Credit cards provide numerous advantages, such as cashback, travel rewards, and purchase protection. Using a credit card for your car loan might seem appealing, but there are important considerations to keep in mind. We’ll delve into everything you need to know to make an informed decision.

By the time you finish reading this article, you’ll have a thorough understanding of whether using a credit card for your monthly car payment aligns with your financial goals. Let’s explore the details!

Read also:Exploring The Wealth And Success Of Brandi Passante

Table of Contents

- Introduction

- Why Use a Credit Card for Car Payments?

- How Does It Work?

- Credit Card Acceptance by Lenders

- Fees Involved in Using Credit Cards

- Advantages of Paying with a Credit Card

- Disadvantages of Paying with a Credit Card

- Alternatives to Credit Card Payments

- Expert Advice on Using Credit Cards

- Conclusion

Why Consider Using a Credit Card for Car Payments?

Understanding the Motivation Behind Credit Card Payments

Using a credit card to pay your monthly car payment can be enticing for several reasons. Many credit cards offer generous rewards programs, such as cashback, travel miles, or points. By charging your car payment to your credit card, you can accumulate these rewards more quickly, which can be a significant incentive. Additionally, credit cards often include purchase protection and extended warranties, providing an extra layer of security in case of disputes or unforeseen issues.

Another compelling reason is cash flow management. If you prefer to delay paying your car loan until your credit card bill comes due, using a credit card can give you additional time to manage your finances effectively. However, it’s essential to carefully weigh the potential costs, such as fees and interest charges, against the benefits before making a decision.

The Process of Paying Your Car Payment with a Credit Card

How Credit Card Payments Work for Car Loans

When you decide to use a credit card for your car payment, the process typically involves several key steps:

- Verify if your lender allows direct credit card payments. Some lenders may offer this as a service for their customers.

- If direct payments aren’t supported, consider third-party services like Plastiq or Paymentus, which facilitate credit card payments for car loans, albeit with a fee.

- Enter your credit card information into the lender’s payment portal or the third-party service platform.

- Review any associated fees before finalizing the payment to ensure you’re fully informed about the costs.

It’s important to note that not all lenders accept credit card payments directly, and some may impose restrictions or additional charges. Always confirm your lender’s policies to avoid unexpected surprises.

Credit Card Acceptance by Lenders: What You Need to Know

Do All Lenders Permit Credit Card Payments?

Not all lenders allow credit card payments for car loans. While some lenders provide this option as a convenience, others may prohibit it entirely. If your lender doesn’t accept credit cards directly, third-party payment processors like Plastiq or Paymentus can serve as intermediaries, enabling you to pay your car loan with a credit card for a fee.

Before proceeding, it’s crucial to verify your lender’s policies regarding credit card payments to ensure compliance and avoid any unforeseen complications.

Read also:Understanding Power Outlets And Electrical Systems In Costa Rica

The Financial Implications: Fees Involved in Using Credit Cards

Breaking Down the Costs

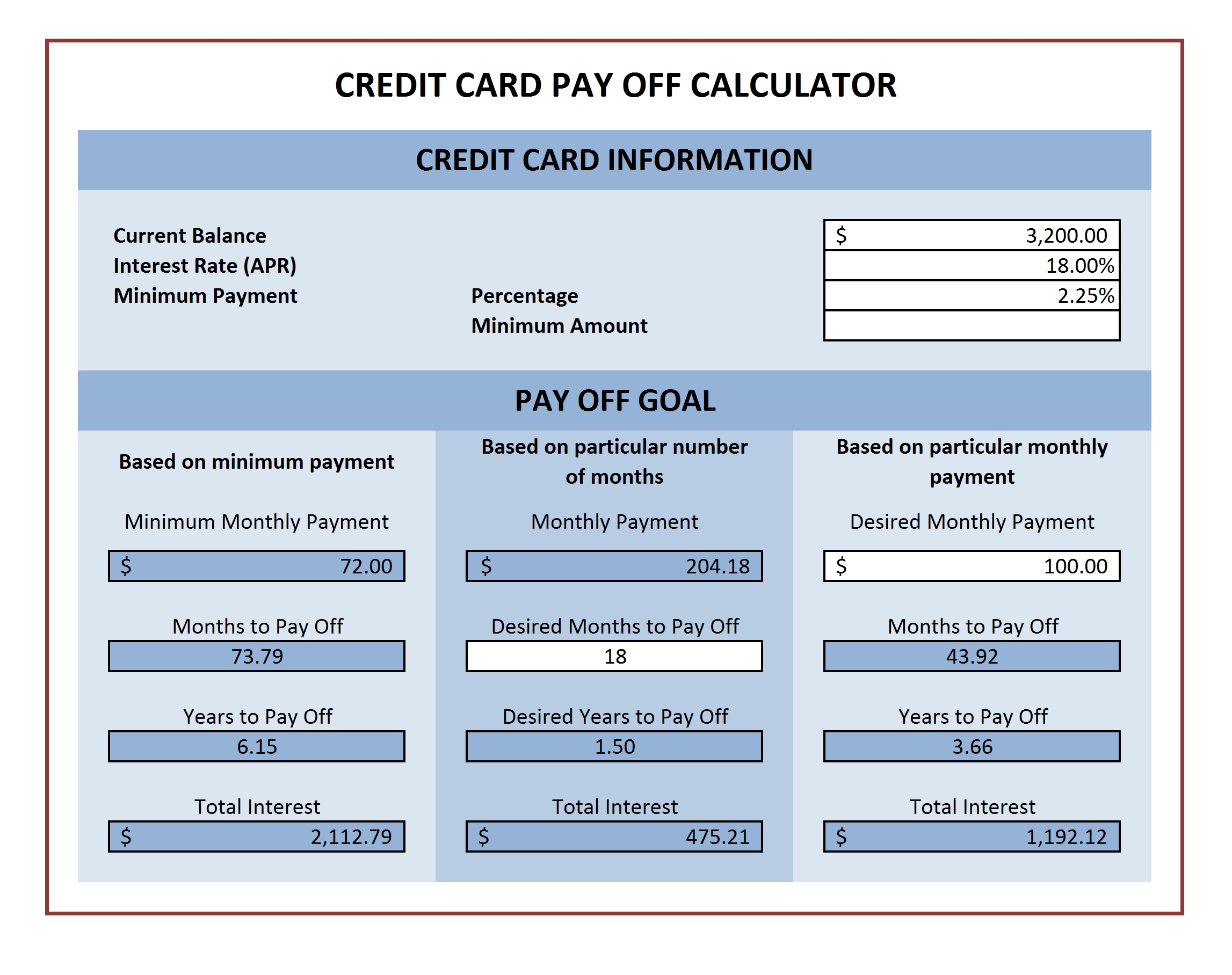

One of the primary concerns when using a credit card for car payments is the associated fees. Lenders or third-party services may charge processing fees, which typically range from 2% to 5% of the payment amount. For instance, if your monthly car payment is $500 and the fee is 3%, you would incur an additional $15 for the convenience.

Additionally, if you carry a balance on your credit card, you may face interest charges, which can offset any rewards or benefits you gain from using the credit card. It’s essential to calculate the total cost, including fees and potential interest, before deciding to proceed.

The Benefits of Paying with a Credit Card

What Are the Advantages?

Paying your car payment with a credit card offers several notable advantages:

- Rewards Accumulation: Earn valuable cashback, travel miles, or points by charging your car payment to your credit card.

- Purchase Protection: Credit cards often provide additional protections, such as dispute resolution and extended warranties, which can be highly beneficial in certain situations.

- Cash Flow Management: Delay the payment until your credit card bill is due, giving you more flexibility to manage your finances effectively.

- Convenience: Simplify the payment process by using a single credit card for multiple expenses, streamlining your financial management.

While these advantages can be appealing, it’s important to weigh them against potential drawbacks, such as fees and interest charges, to ensure it aligns with your financial goals.

The Drawbacks of Using a Credit Card for Car Payments

What Are the Disadvantages?

While using a credit card for car payments has its benefits, there are also several disadvantages to consider:

- Processing Fees: Lenders or third-party services may impose significant fees for credit card payments, which can add up over time.

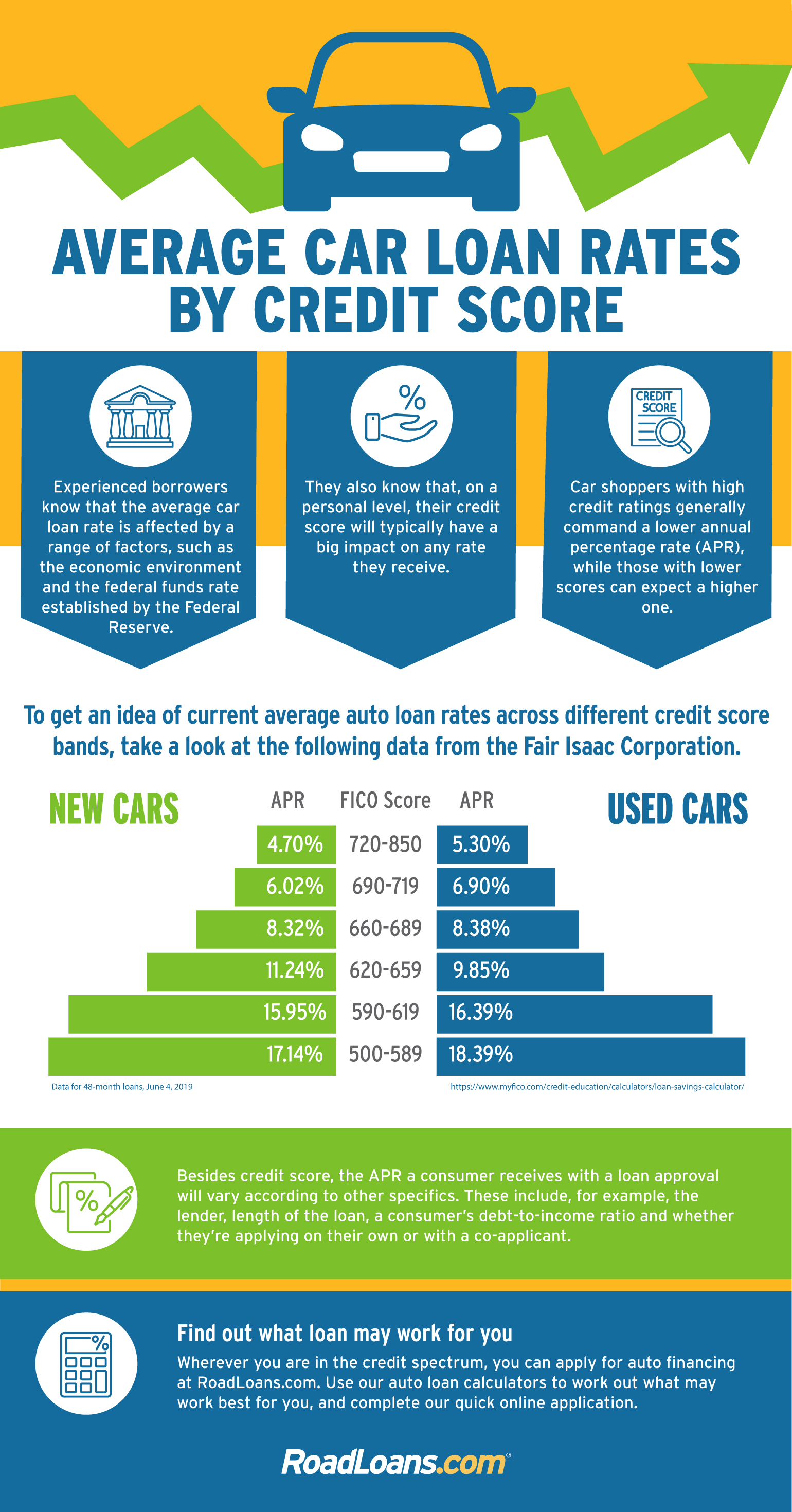

- Interest Charges: If you don’t pay your credit card balance in full each month, you may incur interest charges, increasing the overall cost of your car loan.

- Credit Utilization: Charging large payments to your credit card can increase your credit utilization ratio, potentially affecting your credit score negatively.

- Limitations: Not all lenders accept credit card payments, and some may impose restrictions or caps on the amount you can charge, limiting your options.

It’s crucial to carefully evaluate these drawbacks before deciding to use a credit card for your car payment, ensuring it aligns with your financial priorities.

Exploring Alternatives to Credit Card Payments

What Are the Other Options?

If using a credit card for your car payment isn’t practical or desirable, there are alternative payment methods to consider:

- Bank Transfers: Set up automatic bank transfers to ensure timely payments without incurring additional fees, providing a hassle-free solution.

- Debit Cards: Use a debit card to avoid interest charges while still earning rewards in some cases, offering a cost-effective option.

- Personal Loans: Consider refinancing your car loan with a personal loan that offers lower interest rates, potentially reducing your monthly expenses.

- Payment Plans: Negotiate a payment plan with your lender to better manage your monthly expenses and achieve financial stability.

Each alternative comes with its own set of advantages and disadvantages, so it’s important to choose the option that best suits your financial circumstances and long-term goals.

Financial Expert Insights on Using Credit Cards

What Do Financial Experts Recommend?

Financial experts generally advise caution when using credit cards for car payments. While the rewards and convenience can be attractive, the potential costs, such as fees and interest charges, may outweigh the benefits. Here are some expert tips to guide your decision:

- Calculate the Total Cost: Before proceeding, calculate the total cost of using a credit card, including all fees and potential interest charges, to ensure it’s financially viable.

- Prioritize Rewards: If you have a credit card with a high rewards program, it may be worth using it for your car payment, provided you pay off the balance in full each month to avoid interest.

- Monitor Your Credit Utilization: Keep a close eye on your credit utilization ratio to ensure it remains within a healthy range and doesn’t negatively impact your credit score.

- Explore Other Options: Consider alternative payment methods, such as bank transfers or debit cards, if they better align with your financial needs and goals.

By following these expert recommendations, you can make an informed decision about whether using a credit card for your car payment is the right choice for your financial situation.

Final Thoughts

In summary, paying your monthly car payment with a credit card can be a viable option if managed wisely. The ability to earn rewards, optimize cash flow, and access purchase protections are compelling reasons to consider this approach. However, it’s crucial to weigh the potential costs, such as fees and interest charges, against the benefits to ensure it aligns with your financial priorities.

Before proceeding, verify your lender’s policies regarding credit card payments and explore alternative options if necessary. Always calculate the total cost and monitor your credit utilization to maintain a strong financial profile. By taking these steps, you can make an informed decision that supports your financial well-being.

We encourage you to share your thoughts or experiences in the comments below. If you found this article helpful, please share it with others who might benefit from the information. For additional financial insights, explore our other articles on managing debt, building credit, and achieving financial freedom.