In today's volatile financial markets, managing risk is a crucial aspect of successful investing. Stop-limit orders play a pivotal role in helping traders and investors protect their capital while maximizing potential gains. If you're looking to understand how stop-limit orders can assist in risk management, you've come to the right place.

Whether you're a beginner or an experienced trader, risk management is a fundamental concept that should never be overlooked. A well-planned strategy can help you navigate market fluctuations and avoid significant losses. Stop-limit orders are one of the tools available to traders that can be used effectively to mitigate risks.

This article will delve into the intricacies of stop-limit orders, explaining how they function, their advantages, and how they contribute to a robust risk management strategy. By the end of this guide, you'll have a clear understanding of how stop-limit orders can help safeguard your investments.

Read also:Noah Kahans Net Worth A Comprehensive Guide To His Career And Financial Success

Table of Contents

- Introduction to Stop-Limit Orders

- How Stop-Limit Orders Work

- Benefits of Using Stop-Limit Orders

- Stop-Limit Orders and Risk Management

- Common Mistakes to Avoid

- Strategies for Effective Usage

- Stop-Limit Orders vs Other Order Types

- Real-World Examples

- Tips for Beginners

- Conclusion

Introduction to Stop-Limit Orders

A stop-limit order is a powerful tool in the trader's arsenal, combining the features of a stop order and a limit order. This hybrid order type allows traders to set both a stop price and a limit price, providing greater control over when and at what price a trade will execute. The primary purpose of a stop-limit order is to help manage risk by automatically executing a trade when the market reaches a specified price.

Key Features of Stop-Limit Orders

- Stop price: The price at which the order becomes active.

- Limit price: The maximum or minimum price at which the order will be executed.

- Execution guarantee: Unlike a stop order, a stop-limit order ensures that the trade will only be executed at or better than the specified limit price.

By using stop-limit orders, traders can protect their investments from sudden market movements while maintaining control over the price at which their trades are executed. This makes stop-limit orders an essential component of any risk management strategy.

How Stop-Limit Orders Work

Understanding the mechanics of stop-limit orders is essential for effective risk management. When a stop-limit order is placed, it remains inactive until the market price reaches the specified stop price. Once the stop price is reached, the order becomes a limit order, which will only be executed at or better than the specified limit price.

Steps in the Execution Process

- The order is placed with both a stop price and a limit price.

- The order remains inactive until the market price reaches the stop price.

- Once the stop price is reached, the order becomes active as a limit order.

- The trade is executed only if the market price meets or exceeds the limit price.

This two-step process ensures that traders have greater control over the price at which their trades are executed, reducing the risk of unfavorable executions during volatile market conditions.

Read also:Lauren Lindsey Donzis A Rising Star In The Entertainment Industry

Benefits of Using Stop-Limit Orders

Stop-limit orders offer several advantages that make them an attractive option for traders looking to manage risk effectively.

1. Price Control

With stop-limit orders, traders can set a specific price range within which their trades will be executed. This ensures that trades are not executed at unfavorable prices, providing peace of mind and reducing the risk of significant losses.

2. Risk Mitigation

By setting a stop price, traders can limit their exposure to sudden market movements. This helps protect their investments from unexpected price drops or spikes, ensuring that losses are kept within acceptable limits.

3. Flexibility

Stop-limit orders offer greater flexibility compared to traditional stop orders. Traders can customize their orders to suit their specific needs and risk tolerance, making them a versatile tool for managing risk in various market conditions.

Stop-Limit Orders and Risk Management

Risk management is a critical component of successful trading, and stop-limit orders are an integral part of this process. By setting predefined price levels, traders can control their exposure to market volatility and protect their investments from unforeseen events.

Key Risk Management Strategies

- Set stop prices based on your risk tolerance and investment goals.

- Use limit prices to ensure trades are executed at favorable prices.

- Regularly review and adjust your stop-limit orders to reflect changing market conditions.

By incorporating stop-limit orders into your trading strategy, you can effectively manage risk and enhance your overall trading performance.

Common Mistakes to Avoid

While stop-limit orders are a powerful tool, they can also lead to unintended consequences if not used correctly. Here are some common mistakes to avoid when using stop-limit orders:

1. Setting Unrealistic Limit Prices

Setting a limit price that is too far from the market price can result in missed trading opportunities. Ensure that your limit price is realistic and reflects current market conditions.

2. Ignoring Market Volatility

Market volatility can cause stop-limit orders to be triggered unexpectedly. Be aware of market conditions and adjust your orders accordingly to avoid unnecessary losses.

3. Failing to Monitor Orders

Regularly review your stop-limit orders to ensure they align with your current risk management strategy. Market conditions can change rapidly, and failing to adjust your orders can lead to suboptimal results.

Strategies for Effective Usage

To maximize the benefits of stop-limit orders, consider implementing the following strategies:

1. Combine with Other Risk Management Tools

Use stop-limit orders in conjunction with other risk management tools, such as position sizing and diversification, to create a comprehensive risk management plan.

2. Set Realistic Price Targets

Ensure that your stop and limit prices are based on thorough analysis and realistic expectations. This will help you avoid missed trading opportunities and unnecessary losses.

3. Stay Informed

Stay up-to-date with market news and trends to make informed decisions about your stop-limit orders. This will help you adapt to changing market conditions and optimize your risk management strategy.

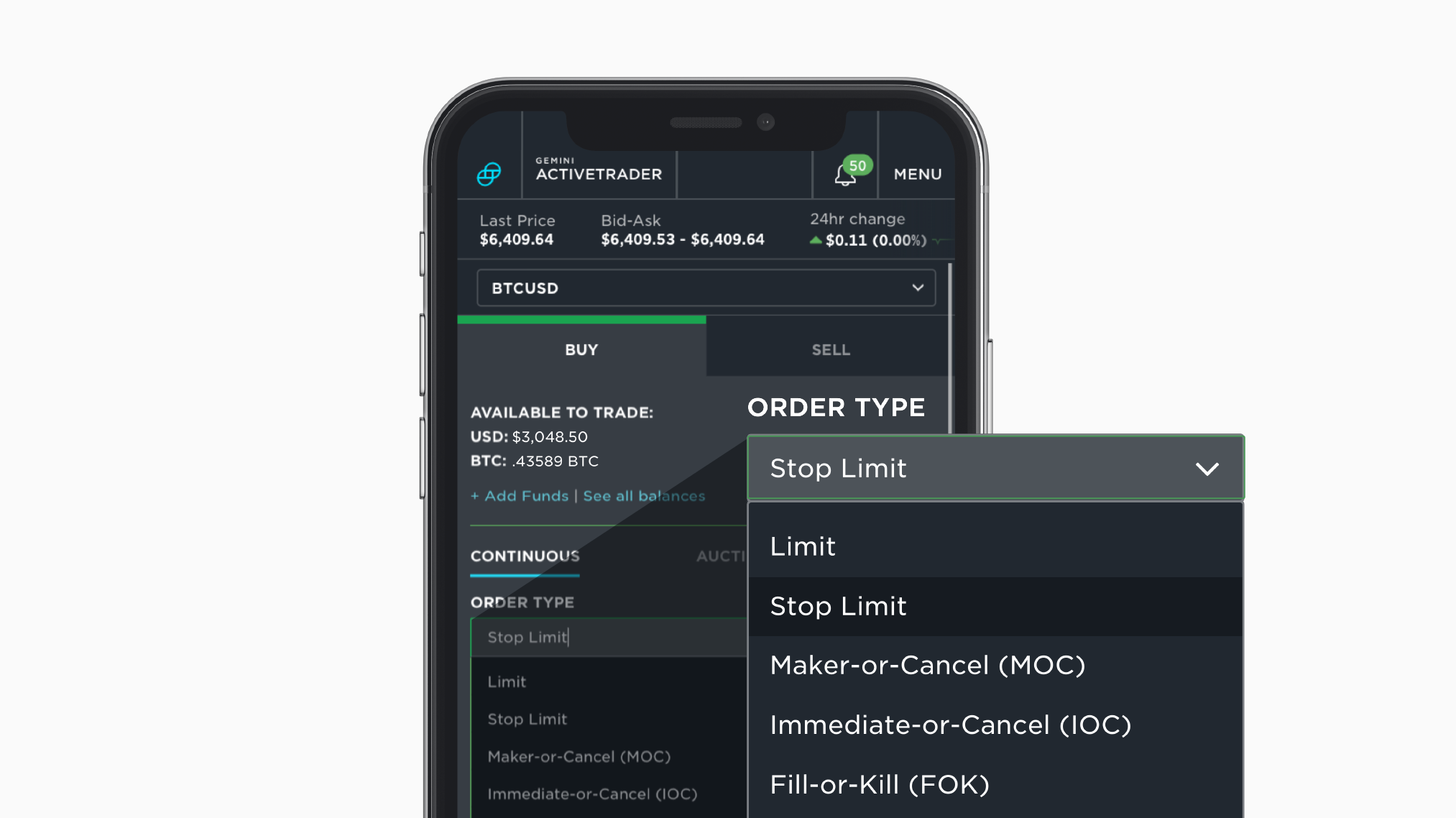

Stop-Limit Orders vs Other Order Types

While stop-limit orders are a powerful tool for managing risk, they are not the only option available to traders. Here's a comparison of stop-limit orders with other common order types:

1. Market Orders

Market orders are executed immediately at the current market price. While they offer no price control, they guarantee execution, making them suitable for situations where speed is more important than price.

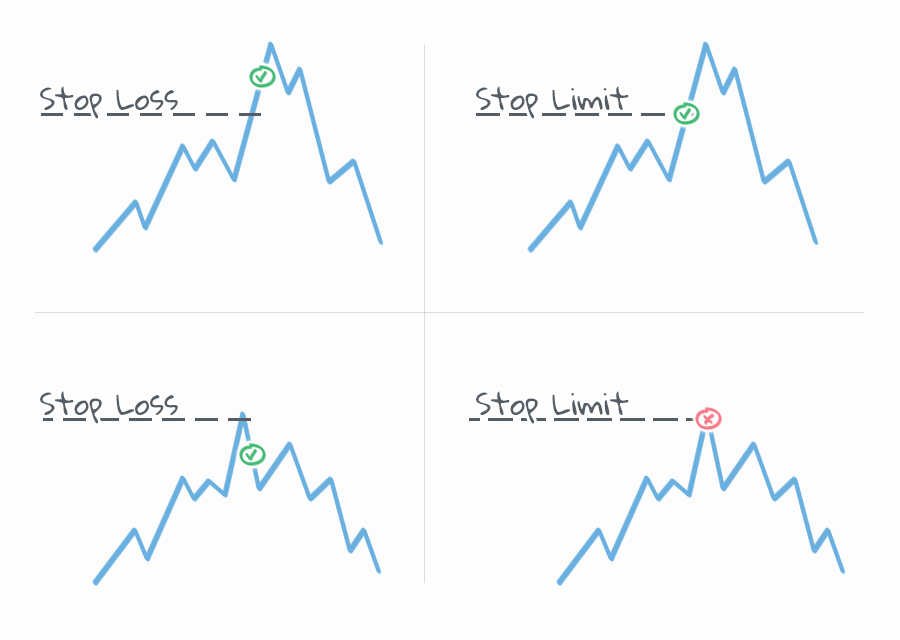

2. Stop Orders

Stop orders become market orders once the stop price is reached. While they offer some price control, they do not guarantee execution at a specific price, making them less effective than stop-limit orders in volatile markets.

3. Limit Orders

Limit orders are executed only at or better than the specified price. While they offer price control, they do not provide the additional protection of a stop price, making them less effective for managing risk in rapidly changing markets.

Real-World Examples

Let's look at a few real-world examples of how stop-limit orders can be used to manage risk effectively:

Example 1: Protecting Profits

A trader buys a stock at $50 and sets a stop-limit order with a stop price of $45 and a limit price of $44. If the stock price drops to $45, the order becomes active as a limit order, ensuring that the trade is executed at $44 or better. This protects the trader's profits while maintaining control over the execution price.

Example 2: Limiting Losses

A trader sells a stock short at $60 and sets a stop-limit order with a stop price of $65 and a limit price of $66. If the stock price rises to $65, the order becomes active as a limit order, ensuring that the trade is executed at $66 or worse. This limits the trader's potential losses while maintaining control over the execution price.

Tips for Beginners

If you're new to trading and considering using stop-limit orders, here are some tips to help you get started:

- Start by learning the basics of trading and risk management.

- Practice using stop-limit orders in a demo account before implementing them in live trading.

- Seek guidance from experienced traders or financial advisors to refine your strategy.

Conclusion

Stop-limit orders are a valuable tool for managing risk in the financial markets. By combining the features of stop orders and limit orders, they offer traders greater control over the price at which their trades are executed, reducing the risk of unfavorable executions during volatile market conditions.

As you incorporate stop-limit orders into your trading strategy, remember to set realistic price targets, stay informed about market conditions, and regularly review and adjust your orders to ensure they align with your risk management goals. By doing so, you can effectively manage risk and enhance your overall trading performance.

We invite you to share your thoughts and experiences with stop-limit orders in the comments below. Your feedback can help others learn and grow in their trading journey. Don't forget to explore other articles on our site for more insights into the world of finance and investing.