Efficiently managing your Texas Comptroller account is essential for staying compliant with state regulations, ensuring timely tax filings, and maintaining accurate financial records. Whether you're a business owner, individual taxpayer, or financial professional, mastering the secure login process is key to a hassle-free experience. The Texas Comptroller login portal serves as a gateway to a wide array of services, including tax filings, payment processing, and comprehensive account management. With proper guidance, you can confidently navigate the system and keep your financial records current and organized. This resource will provide detailed instructions to help you make the most of this indispensable tool.

The Texas Comptroller of Public Accounts plays a pivotal role in overseeing the state's financial health, including tax collection, revenue distribution, and fostering public transparency. By offering a user-friendly platform, the comptroller ensures that individuals and businesses can access their accounts effortlessly. Whether you're logging in for the first time or troubleshooting an issue, this comprehensive guide will walk you through every step, helping you achieve seamless access to your account.

This article will cover everything from setting up your account to resolving common login challenges. By the end, you'll have a thorough understanding of how to access your account, utilize its features effectively, and address any potential issues that may arise. Let's delve into the details and explore how you can maximize the benefits of this critical resource.

Read also:How To Safely Identify Live Cables A Comprehensive Guide

Table of Contents

Introduction to Texas Comptroller Login

The Texas Comptroller login is a sophisticated online platform designed to grant taxpayers, businesses, and financial professionals secure access to their accounts. This portal acts as a centralized hub for managing tax-related activities, such as filing returns, making payments, and reviewing account balances. It is maintained by the Texas Comptroller of Public Accounts, the state agency responsible for overseeing Texas's financial operations.

Through the Texas Comptroller login, users can access a variety of services tailored to their specific needs. Businesses can leverage the portal for sales tax reporting, franchise tax filings, and payment processing. Individuals can use it to manage personal tax obligations, view payment history, and retrieve important documents. The platform is engineered to simplify financial management while ensuring compliance with state regulations.

With its secure and intuitive interface, the Texas Comptroller login portal streamlines the management of tax-related tasks. Whether you're a newcomer or an experienced professional, understanding the platform's capabilities and advantages is crucial for maintaining organization and compliance.

Accessing the Texas Comptroller Portal

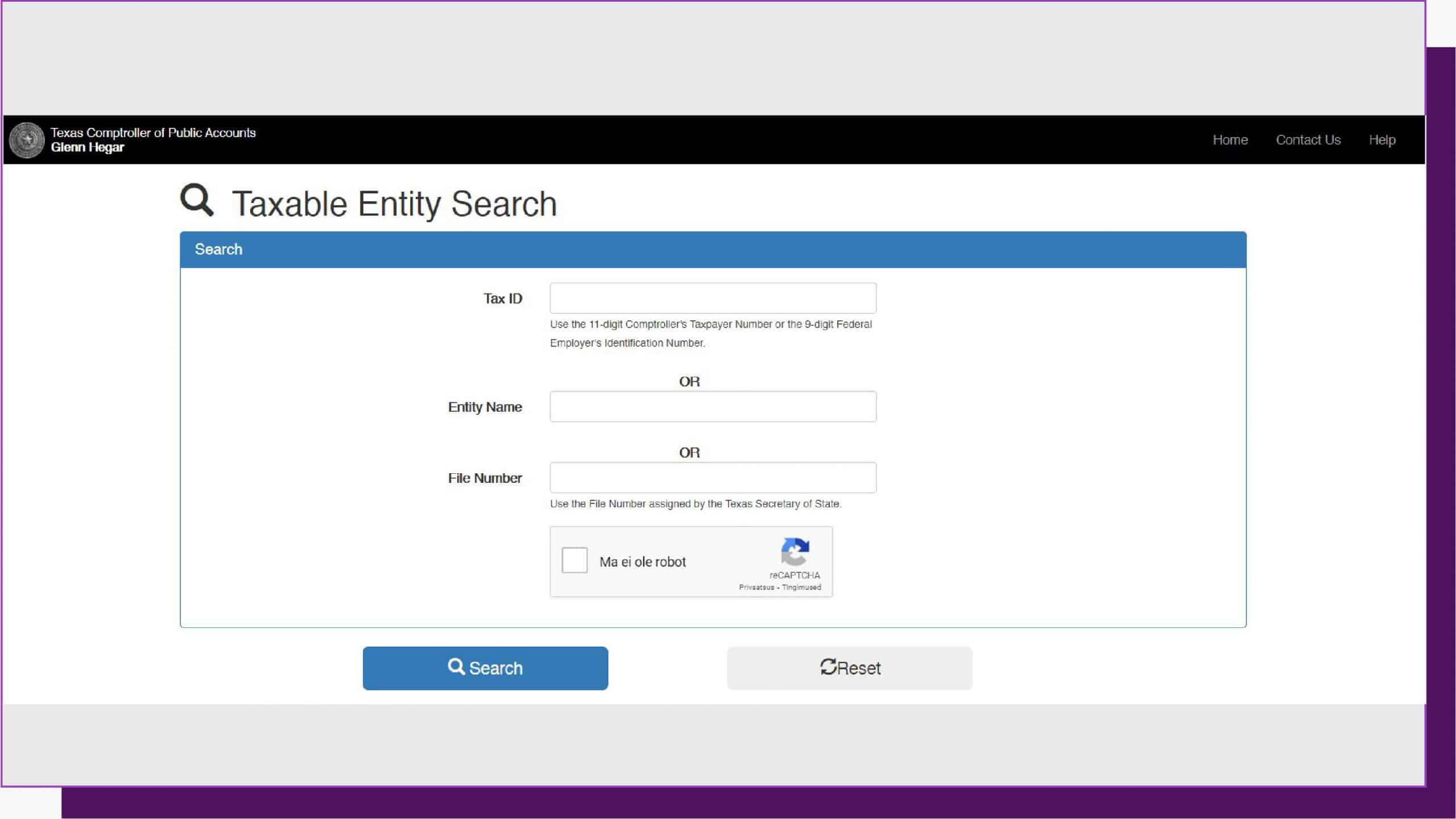

Accessing the Texas Comptroller login portal is a straightforward process, but adhering to a few key steps ensures a seamless experience. Begin by visiting the official Texas Comptroller of Public Accounts website. Look for the login section, typically located on the homepage or under the "Services" tab. Once you locate the login link, click on it to proceed to the login page.

Prior to logging in, ensure you have your credentials ready, including your username and password. If you're a new user, you'll need to register for an account before accessing the portal. The registration process involves providing basic information, such as your name, email address, and taxpayer identification number (TIN).

For added convenience, the Texas Comptroller login portal is accessible on both desktop and mobile devices, allowing users to manage their accounts from virtually anywhere. Whether you're at home, in the office, or on the go, following these steps will grant you access to your account and enable you to utilize the portal's extensive features.

Read also:Understanding The Pokimane Fap Trend Origins Implications And Community Impact

Step-by-Step Login Process

Logging into the Texas Comptroller portal involves a series of straightforward steps designed to ensure security and ease of use. Follow these instructions to gain access to your account:

- Visit the official Texas Comptroller of Public Accounts website.

- Locate the login section and click on the "Login" button.

- Enter your username and password in the designated fields.

- Complete any additional security measures, such as CAPTCHA verification or two-factor authentication.

- Click the "Submit" button to access your account.

Should you encounter difficulties during the login process, refer to the troubleshooting section of this guide for solutions. By following these steps, you can securely access your account and begin managing your tax-related responsibilities.

Recovering Forgotten Credentials

Forgetting your login credentials can be frustrating, but the Texas Comptroller portal offers tools to help you regain access to your account. If you've lost your username or password, follow these steps:

- On the login page, click the "Forgot Username" or "Forgot Password" link.

- Provide the necessary information, such as your email address or taxpayer identification number (TIN).

- Follow the instructions sent to your email to reset your credentials.

If issues persist, contact the Texas Comptroller support team for further assistance. They can guide you through the recovery process and ensure you regain access to your account swiftly and securely.

Why the Texas Comptroller Login is Crucial for Businesses

The Texas Comptroller login is an indispensable resource for businesses operating within the state. It empowers companies to manage their tax obligations efficiently, ensuring adherence to state regulations. Through the portal, businesses can file sales tax returns, pay franchise taxes, and review payment history with ease.

Moreover, the Texas Comptroller login provides access to valuable resources, such as tax calculators, filing deadlines, and compliance guides. These tools assist businesses in staying organized and avoiding penalties for late or incorrect filings. By utilizing the portal, companies can streamline their financial operations, allowing them to focus on growth and expansion.

How to Create an Account for Texas Comptroller Login

Creating an account for Texas Comptroller login is a simple and efficient process. Follow these steps to get started:

- Visit the Texas Comptroller of Public Accounts website.

- Click on the "Register" or "Create Account" button.

- Provide the required information, including your name, email address, and taxpayer identification number (TIN).

- Create a secure username and password for your account.

- Verify your email address to finalize the registration process.

Once your account is established, you can log in and begin utilizing the portal's extensive features. Be sure to safeguard your login credentials to protect your account from unauthorized access.

Key Features of the Texas Comptroller Portal

The Texas Comptroller portal offers a comprehensive suite of features designed to simplify tax management. Some of the standout features include:

- Filing and paying taxes conveniently online.

- Viewing detailed account balances and payment history.

- Accessing essential tax forms and documents.

- Setting up automatic payments and reminders to stay organized.

- Checking important filing deadlines and compliance status.

These features enhance the user experience, making it easier for individuals and businesses to manage their tax-related activities and remain compliant with state regulations.

Troubleshooting Common Texas Comptroller Login Issues

Experiencing issues with the Texas Comptroller login is not unusual, but most problems can be resolved quickly with a few simple steps. Below are some common issues and their corresponding solutions:

- Incorrect Credentials: Carefully verify your username and password. If you're uncertain, use the "Forgot Password" feature to reset your credentials.

- Account Locked: If your account is locked due to multiple failed login attempts, contact the support team to unlock it.

- Technical Errors: Clear your browser's cache and cookies, then attempt to log in again.

If these steps fail to resolve the issue, reach out to the Texas Comptroller support team for additional assistance.

How the Texas Comptroller Ensures Login Security

Security is a top priority for the Texas Comptroller login portal. The system employs cutting-edge encryption and authentication technologies to safeguard user data. Features like two-factor authentication and CAPTCHA verification add an extra layer of protection, ensuring only authorized users can access their accounts.

Users are encouraged to create strong, unique passwords and enable account alerts to monitor for suspicious activity. By adopting these best practices, you can fortify your account and safeguard sensitive information from unauthorized access.

Frequently Asked Questions

Can I Access the Texas Comptroller Login Portal on My Mobile Device?

Yes, the Texas Comptroller login portal is optimized for mobile devices, enabling users to access their accounts seamlessly from smartphones and tablets.

Is There a Fee for Using the Texas Comptroller Login Portal?

No, the portal is free to use for managing tax-related activities and accessing account information, ensuring accessibility for all users.

What Should I Do If I Suspect Unauthorized Access to My Texas Comptroller Login Account?

If you suspect unauthorized access, change your password immediately and notify the Texas Comptroller support team to report the issue.

How Often Should I Review My Texas Comptroller Account?

It's advisable to review your account regularly, especially during tax filing seasons, to ensure all information remains current and accurate.