Are you seeking dependable insights about the Montana Department of Revenue? You’re in the right place. The MT Department of Revenue plays a pivotal role in overseeing state taxes, licenses, and financial regulations that impact individuals and businesses across Montana. Whether you’re a resident, a business owner, or simply interested in how the state manages its finances, gaining a deeper understanding of the MT Department of Revenue can help you stay compliant and make smarter financial decisions.

The Montana Department of Revenue is instrumental in maintaining the state's financial well-being. From collecting state taxes to ensuring resources are allocated efficiently, the department handles a wide array of services, including tax filing, business registration, and property assessments. By prioritizing transparency and fairness, the department fosters trust among taxpayers and businesses, establishing itself as a cornerstone of Montana’s economic stability.

Whether you’re filing your annual taxes, launching a new business, or dealing with property assessments, the MT Department of Revenue provides a suite of tools, resources, and guidance to streamline these processes. With its commitment to accessibility and efficiency, the department ensures that Montana residents and businesses receive the support they need to meet their financial obligations while thriving within the state's economy.

Read also:Exploring The Life And Love Of Kacey Musgraves And Ruston Kelly

Table of Contents

- What Does the MT Department of Revenue Do?

- How Can You File Taxes with the MT Department of Revenue?

- Why Is the MT Department of Revenue Important for Businesses?

- What Resources Are Available from the MT Department of Revenue?

- How Does the MT Department of Revenue Support Property Owners?

- Frequently Asked Questions About the MT Department of Revenue

- How Can You Contact the MT Department of Revenue?

- What Are the Common Tax Mistakes to Avoid?

- How Does the MT Department of Revenue Promote Transparency?

- Conclusion: Your Partnership with the MT Department of Revenue

What Are the Responsibilities of the MT Department of Revenue?

The MT Department of Revenue serves as the foundation of Montana’s financial framework. It administers state taxes, manages business licenses, and ensures adherence to state laws. The department collects revenue from multiple sources, such as income tax, property tax, and sales tax, which are subsequently allocated to fund vital services like education, healthcare, and infrastructure development.

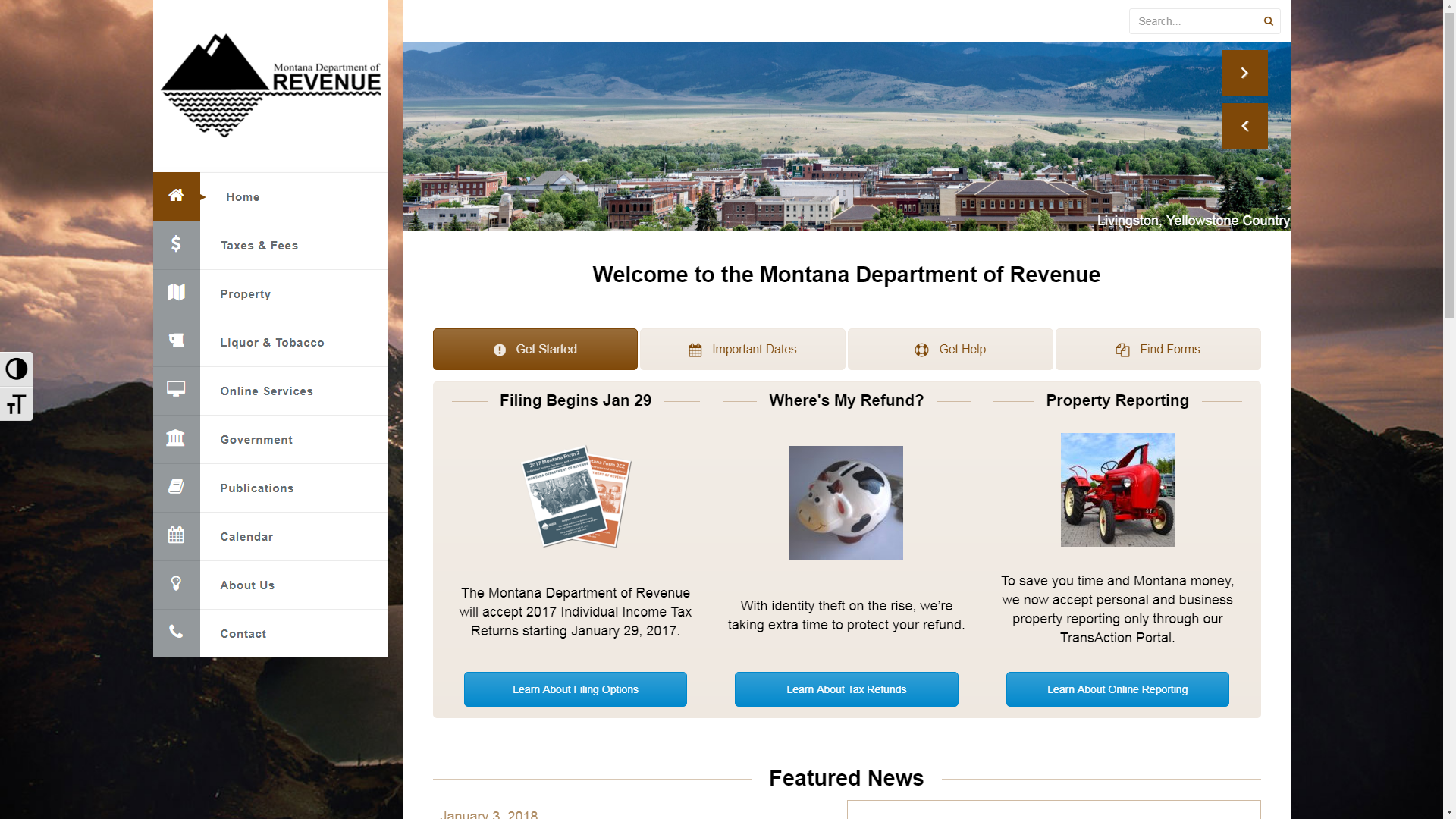

One of the department’s primary functions is to provide guidance and support to taxpayers. Whether you’re an individual filing annual taxes or a business owner navigating intricate regulations, the MT Department of Revenue offers resources to simplify the process. Through online tools and in-person assistance, the department ensures taxpayers have access to the information they need to fulfill their obligations.

Moreover, the department plays a crucial role in driving economic growth. By offering incentives for businesses and implementing equitable tax policies, the MT Department of Revenue cultivates a business-friendly environment in Montana. This not only attracts new businesses but also encourages existing ones to expand, contributing to the state’s overall prosperity.

How to File Taxes with the MT Department of Revenue

Filing taxes with the MT Department of Revenue is a streamlined process, thanks to the department’s user-friendly online platform. Whether you’re filing as an individual or a business, the department provides step-by-step guidance to ensure accuracy and compliance. Here’s how you can begin:

- Create an Account: Visit the official MT Department of Revenue website and establish an account. This will grant you secure access to your tax records and enable you to file your returns.

- Gather Necessary Documents: Collect all relevant documents, including W-2s, 1099s, and receipts for deductions, to ensure accurate filing.

- Submit Your Return: Use the online portal to complete and submit your tax return. The system will guide you through each step, ensuring no critical details are overlooked.

If you encounter challenges during the filing process, the MT Department of Revenue offers customer support to assist you. Their knowledgeable staff can address questions or concerns, ensuring your tax filing experience is as seamless as possible.

Why Is the MT Department of Revenue Vital for Businesses?

For businesses operating in Montana, the MT Department of Revenue is an indispensable partner. The department provides a range of services tailored to the needs of businesses, from registration to tax compliance. Here’s why the MT Department of Revenue is crucial for businesses:

Read also:Exploring The Spiritual Journey Of Nick Mohammed Faith Family And Career

- Business Registration: All businesses in Montana must register with the MT Department of Revenue to secure the necessary licenses and permits.

- Tax Compliance: The department ensures businesses adhere to state tax laws, helping them avoid penalties and legal complications.

- Financial Incentives: The MT Department of Revenue offers various incentives, such as tax credits and deductions, to promote business growth and innovation.

By collaborating closely with the MT Department of Revenue, businesses can ensure compliance while capitalizing on opportunities to reduce their tax liabilities. This partnership is essential for sustained success in Montana’s competitive business landscape.

What Tools and Resources Does the MT Department of Revenue Offer?

The MT Department of Revenue provides a wealth of resources to assist taxpayers and businesses in navigating their financial responsibilities. These resources include:

- Online Tools: The department’s website features calculators, forms, and guides to simplify tax filing and compliance.

- Educational Workshops: The MT Department of Revenue conducts workshops and webinars to educate taxpayers about their obligations and rights.

- Customer Support: Whether you need help filing your taxes or resolving disputes, the department’s customer support team is available to assist you.

These resources empower taxpayers and businesses to save time, reduce stress, and remain compliant with state regulations. By utilizing these offerings, you can enhance your financial management and achieve greater peace of mind.

How Does the MT Department of Revenue Assist Property Owners?

Property owners in Montana depend on the MT Department of Revenue for accurate assessments and fair taxation. The department oversees property tax administration, ensuring assessments are conducted fairly and transparently. Here’s how the MT Department of Revenue supports property owners:

Property Assessments: The department conducts regular assessments to determine property values, which are used to calculate property taxes. This ensures property owners pay a fair amount based on the value of their assets.

Tax Relief Programs: The MT Department of Revenue offers various programs to help property owners reduce their tax burden. These programs are designed to assist seniors, veterans, and low-income households, ensuring that property ownership remains affordable in Montana.

Appeals Process: If a property owner disagrees with their assessment, the MT Department of Revenue provides a clear appeals process. This allows property owners to challenge assessments and ensure they are treated equitably.

Frequently Asked Questions About the MT Department of Revenue

How Can You Reach the MT Department of Revenue?

If you have questions or require assistance, the MT Department of Revenue is just a phone call or email away. You can contact them via their official website, where you’ll find contact information for various departments. Whether you need help with tax filing, business registration, or property assessments, the department’s staff is ready to assist you.

What Tax Mistakes Should You Avoid?

Filing taxes can be intricate, but sidestepping common errors can save you time and money. Some frequent mistakes include failing to report all income, missing deadlines, and not taking advantage of available deductions. The MT Department of Revenue provides resources to help you avoid these pitfalls and ensure accurate filing.

How Does the MT Department of Revenue Foster Transparency?

Transparency is a core value for the MT Department of Revenue. The department publishes annual reports, financial statements, and other documents to keep taxpayers informed about its operations. By promoting openness and accountability, the MT Department of Revenue builds trust with the public and ensures its policies and practices align with the needs of Montana residents.

Conclusion: Partnering with the MT Department of Revenue

The MT Department of Revenue is more than a government agency—it’s a partner in your financial journey. Whether you’re an individual taxpayer, a business owner, or a property owner, the department provides the tools, resources, and support you need to succeed. By staying informed and leveraging the department’s offerings, you can ensure compliance, reduce stress, and contribute to Montana’s economic growth. Embrace this partnership to navigate your financial responsibilities with confidence.