Chase personal lines of credit have emerged as a highly versatile financial instrument for individuals looking to manage their expenses with greater flexibility. Whether you're renovating your home, consolidating debt, or addressing unforeseen expenses, understanding how these lines of credit function is essential. This guide will explore the intricacies of Chase personal lines of credit, empowering you to make well-informed decisions about your financial future.

In the ever-evolving economic landscape, having access to liquidity and financial adaptability can be transformative. Chase personal lines of credit cater to those in need of funds, offering a more flexible alternative to traditional loans. Unlike fixed loans that provide a lump sum, these lines of credit allow you to withdraw funds as required, giving you both convenience and control over your financial situation.

As you delve deeper into the realm of personal lines of credit, it's crucial to evaluate their advantages and potential downsides. This guide will cover everything from eligibility criteria and interest rates to strategies for using your line of credit responsibly. Let's begin!

Read also:Discover The World Of Cooked Sushi A Flavorful Journey Beyond Raw Fish

Table of Contents

- Understanding Chase Personal Lines of Credit

- Eligibility Requirements

- Interest Rates and Fees

- Advantages of Chase Personal Lines of Credit

- Potential Challenges

- The Application Process

- Strategies for Responsible Usage

- Comparing Chase Personal Lines of Credit with Other Options

- Frequently Asked Questions

- Conclusion

Understanding Chase Personal Lines of Credit

Chase personal lines of credit are crafted to offer borrowers a reliable and flexible source of funds. Unlike conventional loans, which provide a single, upfront payment, a line of credit enables you to withdraw funds as needed, up to a predetermined limit. This feature makes it an excellent choice for managing ongoing expenses or addressing unexpected financial requirements.

What Makes Chase Unique?

As one of the largest financial institutions in the United States, Chase distinguishes itself through competitive terms and exceptional customer service. With a reputation for reliability, Chase ensures that borrowers have access to the tools and resources necessary to achieve their financial objectives.

Key features of Chase personal lines of credit include variable interest rates, no annual fees, and the ability to repay only the amount you've utilized. These advantages make it a highly adaptable solution for various financial scenarios.

Eligibility Requirements

To qualify for a Chase personal line of credit, applicants must satisfy specific criteria. Below are some of the primary factors that Chase considers during the approval process:

- Credit Score: A solid credit score (typically 670 or higher) is vital for approval.

- Income Verification: Chase will assess your income to ensure your ability to repay the line of credit.

- Employment History: Stable employment or a dependable income source is necessary.

- Debt-to-Income Ratio: Your existing debt obligations should not exceed a specific percentage of your income.

How Chase Assesses Applicants

Chase employs a combination of credit reports, income documentation, and other financial data to evaluate your eligibility. By maintaining a robust financial profile, you enhance your likelihood of securing favorable terms for your line of credit.

Interest Rates and Fees

Comprehending the interest rates and fees tied to a Chase personal line of credit is essential for effective cost management. Below are some critical aspects to consider:

Read also:The Ultimate Guide To Cooking Shrimp To Perfection

- Variable Interest Rates: Chase provides variable interest rates, meaning the rate can adjust according to market conditions.

- No Annual Fees: One of the most appealing aspects of Chase's personal lines of credit is the absence of annual fees.

- Draw Period: During the draw period, you can access funds as needed and only pay interest on the amount you withdraw.

Minimizing Interest Expenses

To reduce interest expenses, it's crucial to repay borrowed amounts promptly and avoid withdrawing more than necessary. By staying informed about your interest rate and payment schedule, you can manage your line of credit responsibly.

Advantages of Chase Personal Lines of Credit

Chase personal lines of credit offer several benefits that make them an appealing option for borrowers. Below are some of the primary advantages:

- Flexibility: Withdraw funds as needed, up to your approved limit.

- Control: Pay interest solely on the amount you use, rather than the entire credit line.

- No Annual Fees: Enjoy access to funds without unnecessary charges.

- Multiple Uses: Utilize the funds for a variety of purposes, including home improvements, debt consolidation, and unexpected expenses.

Why Select Chase?

With its extensive financial network and dedication to customer satisfaction, Chase stands out as a trusted provider of personal lines of credit. Borrowers can rely on Chase's expertise and resources to navigate their financial journey confidently.

Potential Challenges

While Chase personal lines of credit offer numerous benefits, there are also potential challenges to consider:

- Variable Interest Rates: Rates can increase, leading to higher borrowing costs.

- Repayment Obligations: Failing to repay on time can result in penalties and harm to your credit score.

- Usage Temptation: The convenience of a line of credit can lead to overspending if not managed responsibly.

Reducing Risks

To avoid these pitfalls, it's essential to establish a repayment plan and adhere to a budget. By using your line of credit judiciously, you can maximize its benefits while minimizing potential challenges.

The Application Process

Applying for a Chase personal line of credit is a straightforward procedure. Below are the steps you'll need to follow:

- Pre-Qualify: Start by pre-qualifying to determine if you meet the basic eligibility requirements.

- Gather Documentation: Collect necessary documents, such as proof of income and identification.

- Submit Your Application: Complete the application online or in-person at a Chase branch.

- Review Terms: Once approved, carefully examine the terms and conditions of your line of credit.

Tips for a Successful Application

To enhance your chances of approval, ensure your credit report is current and that you meet all eligibility criteria. Additionally, be prepared to provide comprehensive information about your financial situation to support your application.

Strategies for Responsible Usage

Using a Chase personal line of credit responsibly is vital for maintaining financial stability. Below are some strategies to help you manage your line of credit effectively:

- Set a Budget: Determine how much you need to borrow and adhere to that amount.

- Make Timely Payments: Prioritize repaying borrowed amounts to prevent interest accumulation.

- Monitor Your Credit Score: Regularly review your credit report to ensure accuracy and track improvements.

- Review Terms Periodically: Stay informed about any changes to interest rates or fees.

Building Financial Resilience

By following these strategies, you can use your Chase personal line of credit as a tool for building financial resilience and achieving long-term stability.

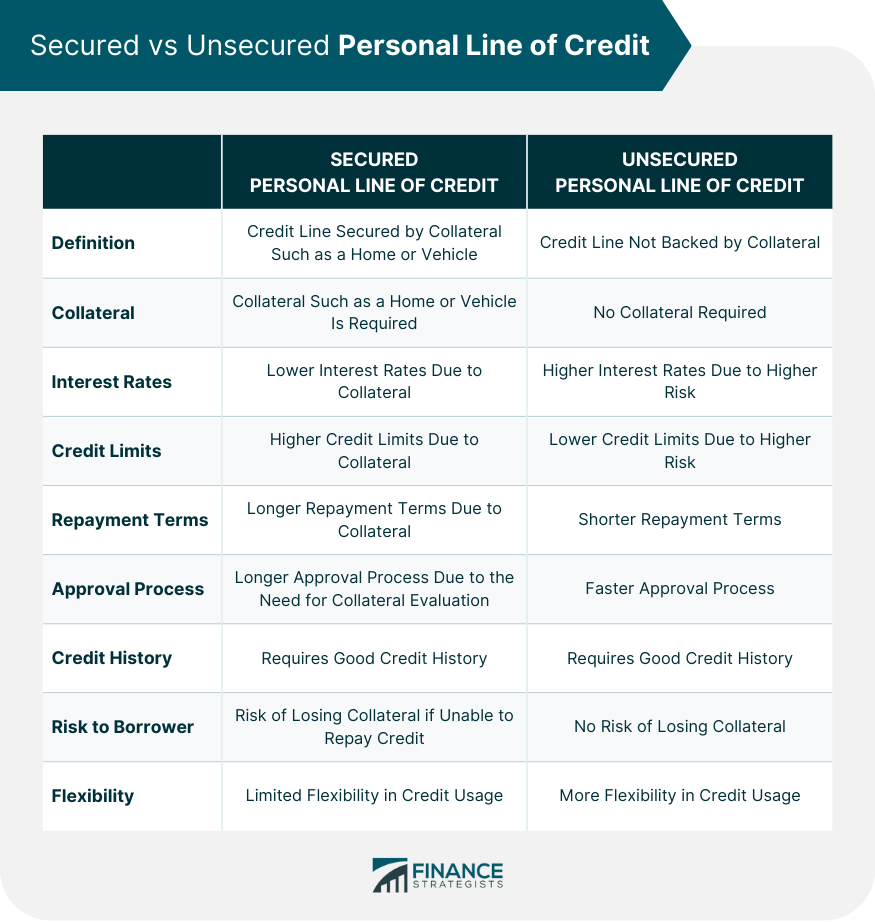

Comparing Chase Personal Lines of Credit with Other Options

When evaluating financial products, it's important to compare Chase personal lines of credit with other alternatives. Below is a brief comparison:

- Personal Loans: Fixed interest rates and repayment schedules make personal loans a predictable choice.

- Credit Cards: Offer similar flexibility but often come with higher interest rates.

- Home Equity Lines of Credit (HELOC): Tied to your home's equity, HELOCs may offer lower interest rates but require collateral.

Selecting the Right Option

The optimal choice depends on your financial goals and circumstances. Chase personal lines of credit provide a balance of flexibility and affordability, making them an attractive option for many borrowers.

Frequently Asked Questions

Below are answers to some common questions about Chase personal lines of credit:

- Can I use my line of credit for any purpose? Yes, you can use the funds for a wide range of purposes, including home improvements, debt consolidation, and unexpected expenses.

- What happens if I miss a payment? Missing a payment can result in late fees and negatively impact your credit score.

- Is there a penalty for early repayment? No, Chase does not impose penalties for repaying your line of credit early.

Clarifying Doubts

By addressing these common questions, we aim to provide clarity and confidence as you explore Chase personal lines of credit.

Conclusion

Chase personal lines of credit provide a flexible and cost-effective solution for managing your financial needs. By understanding the eligibility requirements, interest rates, and strategies for responsible usage, you can maximize the benefits of this financial tool. Remember to carefully weigh the advantages and potential challenges before committing to a line of credit.

We encourage you to share your thoughts and experiences in the comments section below. For additional insights into personal finance and credit management, explore our other articles and resources. Together, let's create a brighter financial future!