In today’s digital age, managing finances has become more accessible than ever, thanks to innovative solutions like the Credit Karma app. Whether you're focused on tracking your credit score, analyzing spending habits, or simply maintaining a strong financial foundation, this app provides a comprehensive set of tools to simplify your financial journey. The Credit Karma app isn’t just another financial tool—it’s a transformative solution that empowers users to take charge of their financial futures.

What truly distinguishes the Credit Karma app is its capacity to deliver real-time updates and personalized insights into your credit profile. Unlike traditional credit monitoring services, this app offers a seamless experience by providing free credit scores, detailed credit reports, and actionable advice—all in one convenient location. With millions of users trusting it daily, the app has solidified its position as an essential companion for anyone aiming to enhance their financial stability.

Furthermore, the Credit Karma app extends beyond its core functionalities to offer tools that assist users in making wiser financial decisions. From recommending credit cards tailored to your specific needs to alerting you about potential identity theft, the app ensures you remain informed and secure. Its intuitive design and accessibility make it indispensable for anyone committed to their financial well-being.

Read also:Exploring The Inspiring Journey Of Paige Tamada Today

Table of Contents

- What is the Credit Karma App?

- How Does the Credit Karma App Function?

- Can the Credit Karma App Assist in Building Credit?

- Key Features of the Credit Karma App

- Is the Credit Karma App Secure?

- How Can the Credit Karma App Save You Money?

- Limitations of the Credit Karma App

- Frequently Asked Questions

What is the Credit Karma App?

The Credit Karma app is a free financial tool designed to help users monitor and enhance their credit health. Since its launch in 2007, the app has rapidly gained popularity for its ability to provide free credit scores and reports without requiring a credit card. Unlike many financial services that charge for similar insights, the Credit Karma app offers its core features at no cost, making it an accessible option for individuals from all financial backgrounds.

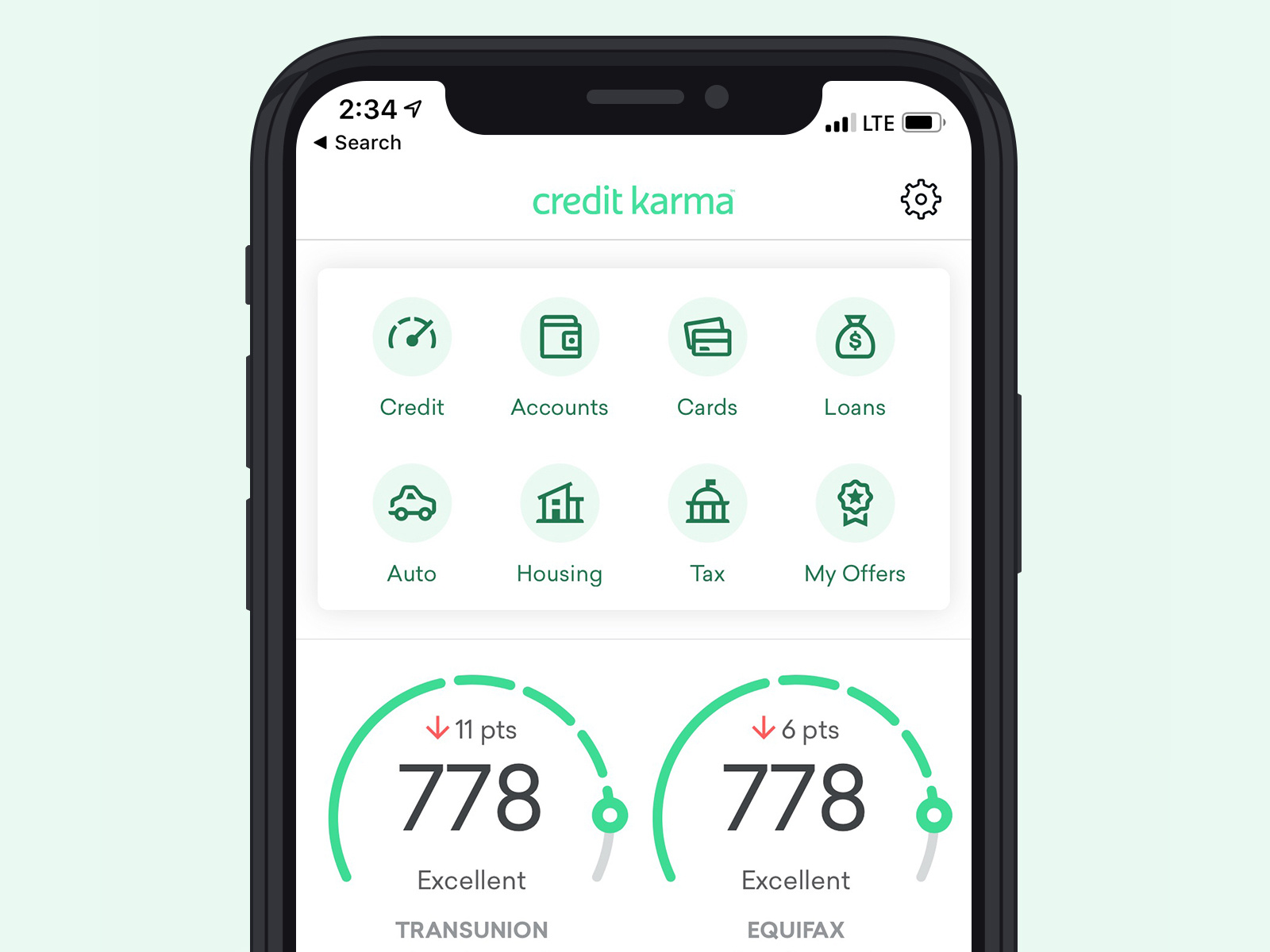

At its heart, the Credit Karma app functions as a credit monitoring platform. It gathers data from two major credit bureaus, TransUnion and Equifax, to give users an accurate picture of their credit status. This includes details such as your credit score, payment history, credit utilization, and outstanding debts. The app also breaks down the factors influencing your score, helping you pinpoint areas for improvement.

However, the Credit Karma app is much more than just a credit score tracker. It also offers a range of financial tools to assist users in making smarter decisions. For instance, it provides personalized recommendations for credit cards and loans based on your credit profile. Additionally, it alerts users to potential identity theft by monitoring suspicious activity on their accounts. This combination of features makes the Credit Karma app a one-stop shop for managing your financial health.

How Does the Credit Karma App Function?

Understanding the inner workings of the Credit Karma app is crucial to fully utilizing its capabilities. The app operates by securely accessing your credit information from TransUnion and Equifax. Once you create an account, you’ll be guided through a verification process involving a series of security questions. This ensures that only you can access your sensitive financial data.

After verification, the Credit Karma app provides a dashboard where you can view your credit score and detailed credit report. The app updates your information weekly, ensuring that you always have the most up-to-date data at your fingertips. This regular updating is especially beneficial if you're actively working to improve your credit score.

One of the app’s standout features is its personalized recommendations. Based on your credit profile, the app suggests financial products like credit cards, personal loans, and auto loans that align with your needs. For example, if you have a high credit score, you might receive offers for premium credit cards with excellent rewards. Conversely, if your score is lower, the app might recommend secured credit cards or credit-building loans to help you improve your standing.

Read also:A Comparative Analysis Of Trudeau And Castro Leadership Styles And Governance Philosophies

Can the Credit Karma App Assist in Building Credit?

Many users wonder whether the Credit Karma app can genuinely help them build credit. While the app itself doesn’t directly impact your credit score, it provides the tools and insights necessary to make informed decisions that can lead to credit improvement. By offering detailed credit reports and actionable advice, the Credit Karma app empowers users to take control of their financial health.

One way the Credit Karma app aids in building credit is by identifying negative factors affecting your score. For instance, it might highlight high credit utilization or missed payments, enabling you to address these issues proactively. Additionally, the app’s weekly updates allow you to track your progress over time, providing motivation to stick to your financial goals.

Another way the Credit Karma app supports credit building is through its personalized recommendations. By suggesting credit products tailored to your profile, the app helps you find opportunities to establish or improve your credit history. Whether it’s a secured credit card for beginners or a balance transfer card for those with existing debt, the app ensures you have access to the right tools for your situation.

Key Features of the Credit Karma App

Credit Monitoring

One of the most remarkable features of the Credit Karma app is its robust credit monitoring capabilities. The app provides real-time updates on your credit score and detailed reports from TransUnion and Equifax. This enables users to stay informed about their financial status and quickly identify any discrepancies or potential issues.

For example, if there’s an unexpected drop in your credit score, the Credit Karma app will notify you and provide insights into what caused the change. This could include late payments, new credit inquiries, or changes in credit utilization. By addressing these issues promptly, you can prevent further damage to your credit profile.

Financial Tools

Beyond credit monitoring, the Credit Karma app offers a variety of financial tools to help users make smarter decisions. These include personalized recommendations for credit cards, loans, and even insurance products. The app also features a "Credit Score Simulator," which allows users to predict how certain actions—like paying off debt or applying for a new credit card—might impact their score.

Additionally, the Credit Karma app includes a feature called "Unclaimed Money," which helps users search for forgotten assets like unclaimed tax refunds or security deposits. This feature adds an extra layer of value, making the app a comprehensive financial management tool.

Is the Credit Karma App Secure?

Security is a top concern for anyone using financial tools, and the Credit Karma app prioritizes this. The app employs bank-level encryption to safeguard your personal and financial information. Furthermore, it uses multi-factor authentication to ensure that only you can access your account.

While the Credit Karma app is free to use, it generates revenue through targeted advertising. For example, it may display offers for credit cards or loans based on your credit profile. However, these ads are clearly labeled, and users are never obligated to accept them. This business model allows the app to remain free while maintaining transparency.

Despite its robust security measures, it’s important to remain vigilant. The Credit Karma app provides alerts for suspicious activity, such as new accounts opened in your name. If you notice anything unusual, you can take immediate action to protect your identity and credit profile.

How Can the Credit Karma App Save You Money?

One of the most appealing aspects of the Credit Karma app is its ability to help users save money. By providing insights into your credit profile, the app enables you to identify areas where you can reduce costs. For example, if you have high-interest debt, the app might recommend balance transfer credit cards with lower rates, helping you save on interest payments.

Additionally, the Credit Karma app offers tools to help you compare financial products. Whether you’re shopping for a new credit card, auto loan, or insurance policy, the app provides personalized recommendations based on your credit profile. This ensures you’re getting the best possible deals without spending hours researching options.

Another way the Credit Karma app saves you money is by helping you avoid unnecessary fees. For example, it alerts you to upcoming bill payments, reducing the risk of late fees. It also provides insights into credit utilization, helping you avoid penalties for exceeding your credit limit.

Limitations of the Credit Karma App

While the Credit Karma app offers numerous benefits, it’s important to be aware of its limitations. One drawback is that it only pulls data from two credit bureaus—TransUnion and Equifax. This means your credit score might differ slightly from the one reported by Experian, the third major credit bureau.

Another limitation is that the Credit Karma app doesn’t offer a FICO score, which is the score most lenders use when evaluating loan applications. While the VantageScore provided by the app is a reliable indicator of your credit health, it may not always align with the FICO score used by banks and financial institutions.

Finally, the app’s targeted advertising can sometimes feel intrusive, even though it’s clearly labeled. Some users may find the constant recommendations for financial products distracting, especially if they’re not actively shopping for new credit options.

Frequently Asked Questions

Does the Credit Karma App Impact Your Credit Score?

No, using the Credit Karma app does not impact your credit score. The app uses a soft inquiry to access your credit information, which has no effect on your score. Hard inquiries, which occur when you apply for new credit, are the only type that can affect your score.

Is the Credit Karma App Truly Free?

Yes, the Credit Karma app is entirely free to use. It generates revenue through targeted advertising, but users are never charged for accessing their credit scores, reports, or financial tools.

Can I File Taxes Using the Credit Karma App?

Yes, the Credit Karma app offers a free tax filing service called Credit Karma Tax. This service allows users to file both federal and state taxes at no cost, making it a convenient option for those looking to save money during tax season.

Conclusion

The Credit Karma app is a powerful tool that can help you take control of your financial future. From monitoring your credit score to providing personalized recommendations, it offers a comprehensive suite of features designed to simplify your financial life. While it has some limitations, its benefits far outweigh any drawbacks, making it an invaluable resource for anyone serious about their financial health.

By leveraging the insights and tools provided by the Credit Karma app, you can make smarter financial decisions, improve your credit score, and save money in the process. Whether you're just beginning your financial journey or looking to refine your existing strategies, the Credit Karma app is a trusted companion that empowers you to achieve your goals.

Ready to take the first step toward better financial health? Download the Credit Karma app today and start exploring its features. With its user-friendly interface and robust capabilities, it’s never been easier to manage your finances and build a brighter financial future.

For more information on credit scores and financial management, check out this resource from the Consumer Financial Protection Bureau.