When it comes to selecting a small business bank account, the importance of proximity cannot be overstated. Having a local bank branch enables you to establish a personal relationship with your banker, access in-person support, and resolve issues promptly. Beyond convenience, many banks offer specialized services for small businesses, such as business loans, credit lines, and merchant services. By searching for "small business bank account near me," you can evaluate various options, fees, and benefits to find the ideal match for your business. This guide will provide comprehensive insights into choosing the best account for your needs.

Choosing the right bank account involves more than just location. It's about understanding the features, fees, and terms that align with your business objectives. Many banks now offer online and mobile banking options, making it easier for small business owners to manage their accounts remotely. Whether you're seeking low fees, high-interest rates, or advanced financial management tools, this article will assist you in navigating the process. Let’s delve into the details and explore how you can make the most informed decision for your business.

Table of Contents

- Why Choose a Local Bank for Your Small Business Bank Account?

- How to Find the Best Small Business Bank Account?

- What Features Should You Look For?

- Common Questions About Small Business Bank Accounts

- Are Online Banks a Good Option for Small Business Bank Accounts?

- What Fees Are Associated with Small Business Bank Accounts?

- How to Compare Small Business Bank Account Options?

- Why Does Personalized Service Matter?

- How to Open a Small Business Bank Account?

- Tips for Managing Your Small Business Bank Account

Why Choose a Local Bank for Your Small Business Bank Account?

Opting for a local bank for your small business bank account offers numerous advantages. Local banks typically have an in-depth understanding of the community and can provide customized solutions to meet your business requirements. They are more likely to offer personalized service, which can be invaluable when seeking advice or support. Additionally, having a nearby physical branch allows you to visit in person, which can be helpful for addressing issues or discussing financial strategies.

Read also:Exploring The Wealth And Success Of Brandi Passante

How Does Proximity Influence Your Business?

The proximity of your bank can significantly impact your business operations. For instance, if you need to make frequent cash deposits, having a nearby branch can save you time and effort. Local banks also tend to respond more quickly to inquiries and issues, ensuring that your business runs smoothly. When searching for "small business bank account near me," consider how the bank's location aligns with your daily operations and long-term goals.

How to Find the Best Small Business Bank Account?

Locating the best small business bank account requires thorough research and comparison. Begin by identifying your business's specific needs, such as transaction limits, access to loans, or integration with accounting software. Once you understand what you're looking for, you can start your search for "small business bank account near me." Utilize online reviews, customer testimonials, and local recommendations to narrow down your options.

What Should You Look For in a Small Business Bank Account?

When evaluating small business bank accounts, consider the following factors:

- Fees: Seek accounts with minimal or no monthly fees, transaction fees, and overdraft fees.

- Interest Rates: Some accounts offer interest on balances, which can contribute to your business's growth.

- Features: Check for features like online banking, mobile apps, and integration with accounting tools.

- Customer Support: Ensure the bank provides reliable and accessible customer support.

What Features Should You Look For?

The features of a small business bank account can differ greatly between banks. Some accounts are designed for startups, while others cater to established businesses. When searching for "small business bank account near me," consider the features that will benefit your business the most. For example, if you frequently handle cash transactions, look for an account with no limits on deposits. If you require access to credit, choose a bank that offers business loans or lines of credit.

Why Are Online Tools Essential for Small Business Bank Accounts?

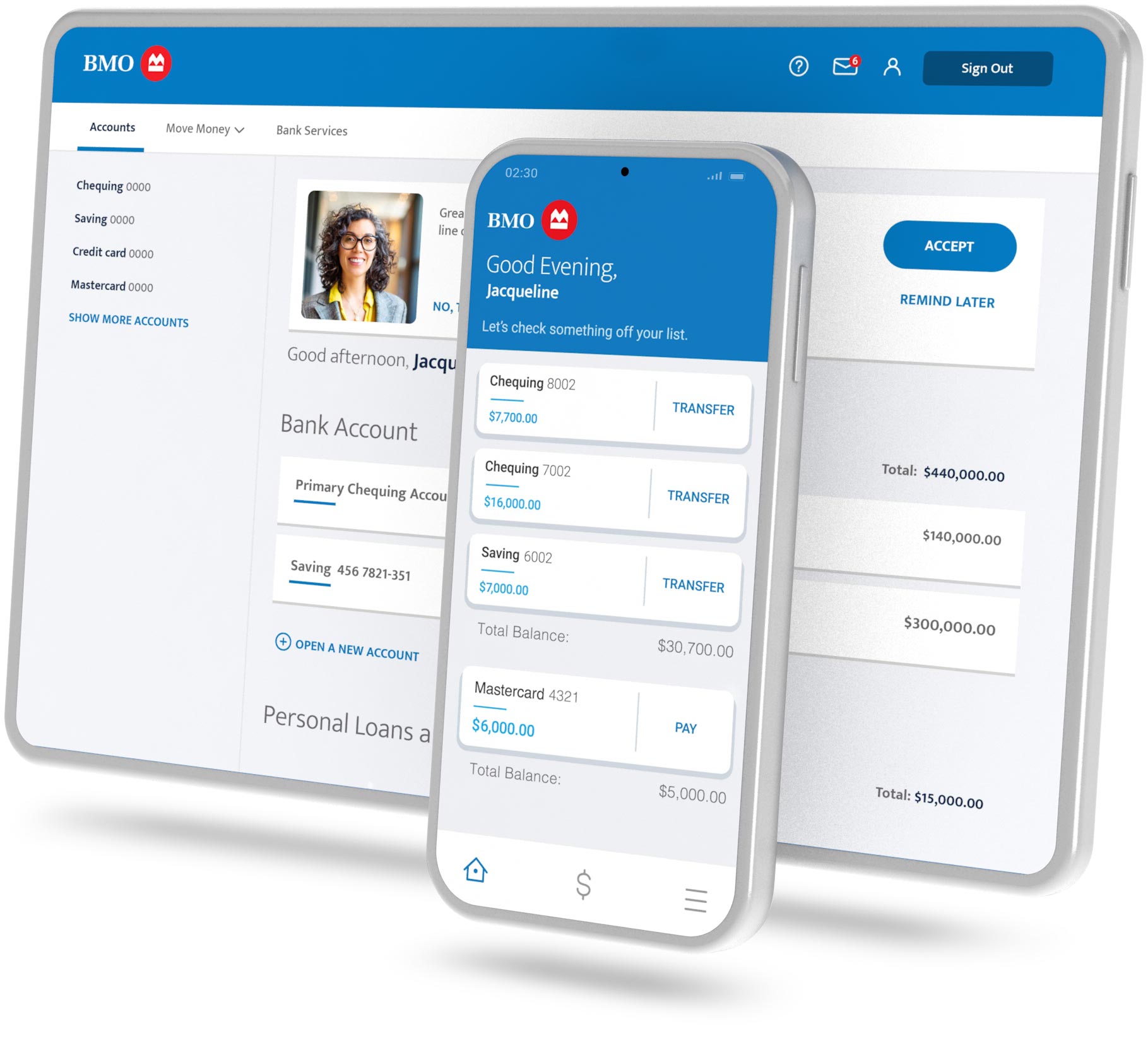

Online tools and mobile apps are increasingly vital for managing small business bank accounts. These tools enable you to monitor your account, transfer funds, and pay bills from any location. Many banks also offer features like expense tracking and invoicing, which can simplify your financial management. When evaluating options, ask yourself: Does this bank provide the digital tools I need to efficiently run my business?

Common Questions About Small Business Bank Accounts

What Documents Are Needed to Open a Small Business Bank Account?

To open a small business bank account, you'll generally need the following documents:

Read also:The Ultimate Guide To Cooking Shrimp To Perfection

- Business registration documents

- Employer Identification Number (EIN)

- Ownership agreements or partnership contracts

- Personal identification for all account signers

Is It Possible to Open a Small Business Bank Account Online?

Yes, many banks now allow you to open a small business bank account online. This can be a convenient option if you don't have time to visit a branch. However, some banks may require you to visit in person to complete the process, especially if you need to submit physical documents. When searching for "small business bank account near me," check if the bank offers an online application process.

Are Online Banks a Suitable Option for Small Business Bank Accounts?

Online banks are becoming a popular choice for small business owners due to their lower fees and advanced digital tools. These banks often provide higher interest rates on balances and fewer restrictions on transactions. However, they may lack the personal touch of a local bank. If you prioritize convenience and cost savings, an online bank could be a great option for your small business bank account.

What Are the Drawbacks of Online Banks for Small Business Bank Accounts?

While online banks offer many advantages, they also have some disadvantages. For example, you may not have access to in-person support or the ability to deposit cash easily. Additionally, some business owners prefer the security of working with a local bank. When deciding between online and local options, consider what matters most to your business.

What Fees Are Associated with Small Business Bank Accounts?

Fees are an important consideration when selecting a small business bank account. Common fees include monthly maintenance fees, transaction fees, and overdraft fees. Some banks waive these fees if you meet certain requirements, such as maintaining a minimum balance. When searching for "small business bank account near me," compare the fee structures of different banks to find the most cost-effective option.

How Can I Avoid Fees on My Small Business Bank Account?

To avoid fees on your small business bank account, consider the following tips:

- Maintain a minimum balance to qualify for fee waivers.

- Select a bank that offers free or low-cost accounts for small businesses.

- Monitor your account regularly to avoid overdrafts and unnecessary charges.

How to Compare Small Business Bank Account Options?

Comparing small business bank accounts requires a methodical approach. Start by listing your business's needs and priorities. Then, research banks in your area and evaluate their offerings. Look for reviews and ratings from other business owners to gauge the quality of service. Finally, visit the banks or their websites to gather detailed information about their accounts.

What Questions Should I Ask When Comparing Small Business Bank Accounts?

When comparing small business bank accounts, ask the following questions:

- What are the monthly fees and how can I avoid them?

- Does the account offer interest on balances?

- What digital tools and features are available?

- What is the bank's reputation for customer service?

Why Does Personalized Service Matter?

Personalized service can significantly impact the management of a small business bank account. Local banks often assign a dedicated account manager who can provide tailored advice and support. This relationship can be invaluable when you need assistance with financial planning, loans, or other services. When searching for "small business bank account near me," consider how the bank's level of service aligns with your needs.

How Can I Build a Strong Relationship with My Bank?

Building a strong relationship with your bank starts with consistent communication. Visit your local branch to introduce yourself and discuss your business goals. Attend networking events or workshops hosted by the bank to deepen your connection. Over time, this relationship can lead to better service and access to exclusive opportunities.

How to Open a Small Business Bank Account?

Opening a small business bank account is a simple process. Begin by gathering the necessary documents and researching banks in your area. Once you've chosen a bank, schedule an appointment to meet with a representative. They will guide you through the application process and help you set up your account.

What Happens After Opening a Small Business Bank Account?

After opening your account, take time to familiarize yourself with its features and tools. Set up online banking and download the mobile app if available. Begin using the account for your business transactions and monitor it regularly to ensure everything is functioning smoothly.

Tips for Managing Your Small Business Bank Account Effectively

Managing your small business bank account effectively requires discipline and organization. Here are some tips to help you stay on top of your finances:

- Reconcile your account regularly to prevent discrepancies.

- Set up automatic payments for recurring expenses.

- Use expense tracking tools to monitor your spending.

- Review your account statements monthly to identify trends and opportunities for savings.

By following these tips and selecting the right small business bank account near you, you can position your business for long-term success. Remember to prioritize features and services that align with your goals, and don't hesitate to seek advice from banking professionals. With the right account, you can focus on growing your business and achieving your dreams.