Getting your first credit card can be an exciting milestone in your financial journey. However, understanding what constitutes a good credit limit for a first credit card is crucial to managing your finances effectively. A credit limit is essentially the maximum amount you're allowed to borrow on your credit card, and it plays a significant role in building credit history and maintaining financial health.

Many first-time credit card users wonder about the ideal credit limit they should aim for. While there isn't a one-size-fits-all answer, there are several factors to consider, such as your income, expenses, and creditworthiness. This article will delve into what makes a good credit limit, how it affects your credit score, and tips for managing it responsibly.

We'll also explore how to improve your chances of getting a higher credit limit, strategies for responsible credit card usage, and resources for further financial education. Whether you're just starting out or looking to refine your financial management skills, this guide has everything you need to know about credit limits for first credit cards.

Read also:Sammy Thigh A Rising Star In The Entertainment World

Table of Contents

- Understanding Credit Limits

- Factors Affecting Credit Limits

- What is an Ideal Credit Limit?

- Impact on Credit Score

- Tips for Managing Credit Limits

- How to Improve Your Credit Limit

- Common Mistakes to Avoid

- Long-Term Benefits of Responsible Credit Card Usage

- Comparing Credit Limits Across Different Cards

- Additional Resources for Financial Education

Understanding Credit Limits

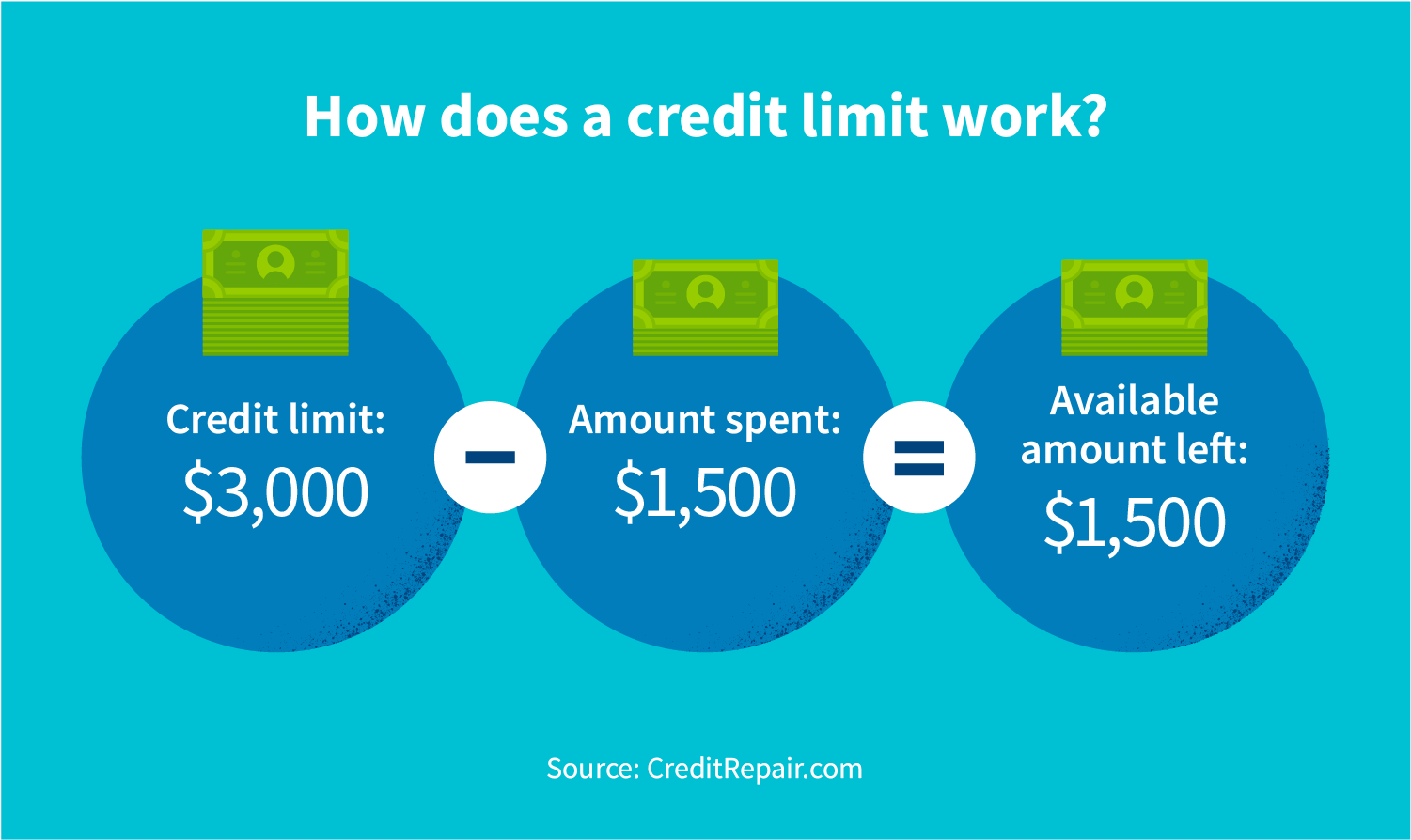

A credit limit refers to the maximum amount of credit a lender is willing to extend to a borrower. For first-time credit card users, the credit limit is typically lower due to limited credit history and income verification. Understanding your credit limit is essential because it directly impacts your ability to make purchases and manage debt responsibly.

Most first credit cards come with credit limits ranging from $300 to $1,000, depending on the issuer and your financial profile. This range is considered reasonable for beginners, as it allows you to build credit without overwhelming debt.

Why Credit Limits Matter

- They help control spending and prevent overspending.

- They influence your credit utilization ratio, which is a key factor in determining your credit score.

- They provide a safety net for unexpected expenses while encouraging responsible financial behavior.

Factors Affecting Credit Limits

Several factors influence the credit limit you receive for your first credit card. These factors are evaluated by credit card issuers to determine your creditworthiness and financial responsibility. Below are the primary considerations:

1. Credit History

Your credit history plays a significant role in determining your credit limit. If you're a first-time borrower, you may not have an extensive credit history, which can result in a lower credit limit. However, this can improve over time as you establish a positive credit record.

2. Income and Employment

Credit card issuers assess your income and employment status to gauge your ability to repay debts. A stable income increases your chances of receiving a higher credit limit.

3. Debt-to-Income Ratio

Your debt-to-income ratio (DTI) is another critical factor. A lower DTI indicates better financial stability, making you more eligible for a higher credit limit.

Read also:Kristi Noem Childrens Ages A Comprehensive Guide

What is an Ideal Credit Limit?

An ideal credit limit for a first credit card is one that aligns with your financial capabilities and allows you to build credit effectively. While $300 to $1,000 is standard for beginners, your ideal limit depends on your personal financial situation.

Assessing Your Needs

- Consider your monthly expenses and how much you can comfortably pay off.

- Choose a limit that encourages responsible spending without encouraging excessive debt.

- Remember that you can request a credit limit increase after demonstrating responsible usage.

Impact on Credit Score

Your credit limit has a direct impact on your credit score through your credit utilization ratio. This ratio is calculated by dividing your total credit card balances by your total credit limits. Experts recommend keeping your credit utilization below 30% to maintain a healthy credit score.

For example, if your credit limit is $1,000, you should aim to keep your balance below $300 to avoid negatively affecting your credit score. Managing your credit limit wisely is a key step in building a strong credit history.

How Credit Utilization Works

- High credit utilization can signal financial instability to lenders.

- Low credit utilization demonstrates responsible credit management.

- Regularly monitoring your credit utilization helps you stay on track with your financial goals.

Tips for Managing Credit Limits

Managing your credit limit effectively is crucial for maintaining financial health and building a strong credit history. Below are some practical tips to help you get started:

1. Set a Budget

Create a budget that includes your credit card expenses. This helps you stay within your credit limit and avoid unnecessary debt.

2. Pay Your Balance in Full

Paying your credit card balance in full each month prevents interest charges and demonstrates financial responsibility to lenders.

3. Monitor Your Credit Report

Regularly check your credit report for errors or discrepancies. This ensures that your credit history accurately reflects your financial behavior.

How to Improve Your Credit Limit

Over time, you can request a credit limit increase from your credit card issuer. To improve your chances of approval, follow these steps:

1. Build a Strong Credit History

Consistently make on-time payments and maintain a low credit utilization ratio to show lenders that you're a responsible borrower.

2. Increase Your Income

If possible, increase your income through promotions, side gigs, or additional employment. A higher income improves your debt-to-income ratio and makes you more eligible for a credit limit increase.

3. Request a Review

Contact your credit card issuer after six months of responsible usage and request a credit limit review. Be prepared to provide updated financial information to support your case.

Common Mistakes to Avoid

As a first-time credit card user, it's essential to avoid common mistakes that can harm your financial health. Below are some pitfalls to watch out for:

- Maxing out your credit limit, which can negatively impact your credit score.

- Missing payments, as late payments can result in penalties and damage your credit history.

- Applying for too many credit cards at once, as this can signal financial instability to lenders.

Long-Term Benefits of Responsible Credit Card Usage

Using your first credit card responsibly can lead to numerous long-term benefits, including:

- Building a strong credit history, which opens doors to better financial opportunities.

- Accessing lower interest rates on loans and mortgages due to a higher credit score.

- Gaining financial discipline and improved money management skills.

Comparing Credit Limits Across Different Cards

Not all credit cards offer the same credit limits, even for first-time users. It's important to compare different credit card options to find the one that best suits your needs. Below are some popular credit cards for beginners:

1. Secured Credit Cards

Secured credit cards require a security deposit, which often determines your credit limit. These cards are ideal for individuals with limited or no credit history.

2. Student Credit Cards

Student credit cards are designed for young adults and typically come with lower credit limits and fewer fees. They're a great way to start building credit while in school.

Additional Resources for Financial Education

For further financial education, consider exploring the following resources:

- Consumer Financial Protection Bureau: Offers valuable information on credit cards and financial management.

- Investopedia: Provides in-depth articles on credit cards, credit scores, and personal finance.

- Credit Karma: A free platform for monitoring your credit score and receiving personalized financial advice.

Kesimpulan

In conclusion, understanding what constitutes a good credit limit for a first credit card is essential for financial success. By considering factors such as credit history, income, and debt-to-income ratio, you can determine the ideal credit limit for your situation. Remember to manage your credit limit responsibly, avoid common mistakes, and take advantage of opportunities to improve your credit limit over time.

We encourage you to share this article with others who may benefit from it and explore our other resources for financial education. If you have any questions or feedback, feel free to leave a comment below. Building a strong financial foundation starts with making informed decisions, and we're here to help you every step of the way.