In the ever-evolving world of investing, understanding value stocks is a cornerstone for anyone aiming to build wealth while managing risks effectively. 5StarsStocks.com has established itself as a reliable platform offering valuable insights into the realm of value stocks. If you're on the lookout for strategies, tools, and resources to enhance your investment portfolio, this article will provide a comprehensive guide to everything you need to know about value stocks.

Value investing is one of the most time-tested approaches to building wealth in the stock market. It involves identifying undervalued stocks with strong fundamentals that are trading below their intrinsic value. This method has been the go-to strategy for legendary investors like Warren Buffett and Benjamin Graham, who have achieved long-term success through disciplined investment practices.

As we delve deeper into this topic, we'll explore the intricacies of value investing, strategies for identifying value stocks, and how platforms like 5StarsStocks.com can assist you in making informed decisions. Whether you're a novice or an experienced investor, this guide will provide you with the knowledge to navigate the complex world of value stocks with confidence and clarity.

Read also:Exploring The Inspiring Journey Of Paige Tamada Today

Understanding Value Stocks

Value stocks represent companies whose share prices are currently lower than their intrinsic value, offering investors the opportunity to purchase them at a discounted rate. These stocks are often characterized by strong financial fundamentals, such as high dividend yields, low price-to-earnings ratios, and robust financial health. According to research by Dimensional Fund Advisors, value stocks have historically demonstrated superior performance compared to growth stocks over extended periods.

Key Characteristics of Value Stocks

Value stocks typically exhibit the following features:

- Low price-to-earnings (P/E) ratios

- High dividend yields

- Strong balance sheets

- Undervalued compared to industry peers

Why Value Stocks Are a Smart Investment

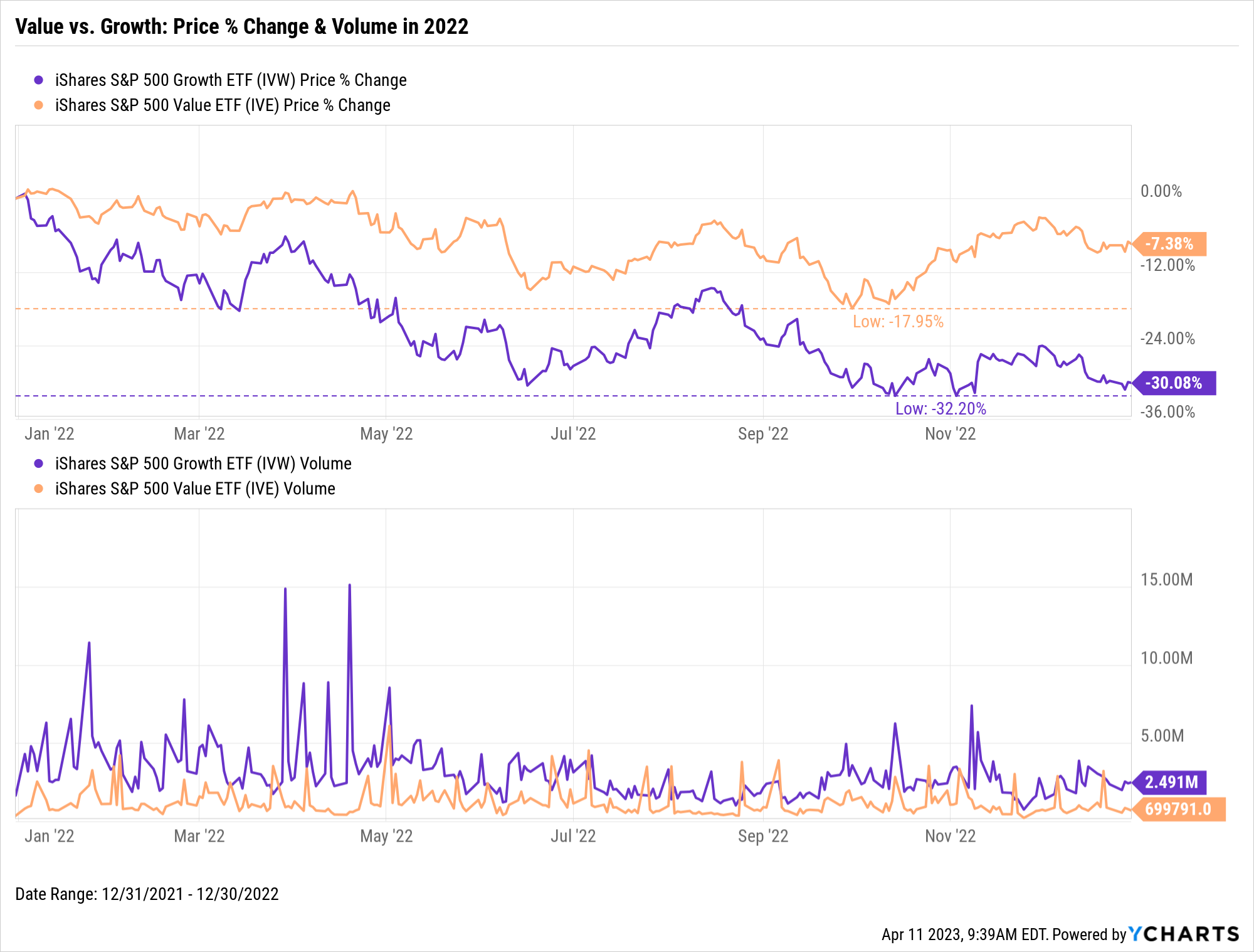

Investing in value stocks offers numerous advantages, including the potential for higher returns, reduced market volatility, and diversification benefits. A study by Morningstar highlights that value-oriented funds have historically delivered better risk-adjusted returns compared to growth-oriented funds. By focusing on companies with solid fundamentals, investors can position themselves for long-term success and stability in the market.

Identifying Value Stocks: Key Metrics to Consider

Essential Metrics for Evaluating Value Stocks

To identify value stocks, investors should focus on key financial metrics such as:

- Price-to-earnings (P/E) ratio

- Price-to-book (P/B) ratio

- Dividend yield

- Debt-to-equity ratio

- Return on equity (ROE)

For instance, a company with a significantly lower P/E ratio compared to its industry peers might be undervalued, making it an attractive candidate for value investors.

Effective Value Investing Strategies

Successful value investing demands a disciplined and strategic approach. Below are some effective strategies to identify and invest in value stocks:

Read also:Mastering Understanding In Japanese A Comprehensive Guide

Margin of Safety: A Time-Tested Concept

Introduced by Benjamin Graham, the concept of margin of safety involves purchasing stocks at a substantial discount to their intrinsic value. This strategy helps mitigate potential downside risks while maximizing the potential for long-term gains.

Bottom-Up Approach: Focusing on Individual Companies

This strategy emphasizes analyzing individual companies rather than macroeconomic factors. By evaluating a company's financial health, competitive advantage, and growth prospects, investors can identify undervalued stocks with strong fundamentals.

The Importance of 5StarsStocks.com in Value Investing

5StarsStocks.com serves as an invaluable resource for investors seeking insights into value stocks. The platform offers expert analysis, stock ratings, and investment tools designed to assist users in making informed decisions. User reviews consistently praise 5StarsStocks.com for helping countless investors achieve their financial objectives through its comprehensive approach to value investing.

The Historical Performance of Value Stocks

Historically, value stocks have outperformed growth stocks over the long term. A study by Fama and French revealed that value stocks generated an annualized return premium of approximately 5% over growth stocks between 1926 and 2021. This performance underscores the significance of incorporating value stocks into a well-diversified investment portfolio.

Dispelling Common Misconceptions About Value Stocks

Myth: Value Stocks Are Always Cheap

A common misconception is that value stocks are always inexpensive. While value stocks may trade at a discount to their intrinsic value, they often possess strong fundamentals that justify their price. Investors should prioritize identifying companies with robust financial health rather than merely chasing low-priced stocks.

Myth: Value Investing Is Only for Long-Term Investors

Although value investing is often associated with long-term strategies, it can also be effective for short-term traders. By identifying mispriced stocks and capitalizing on market inefficiencies, investors can generate profits in both short and long-term timeframes.

Risks Associated with Value Stocks

Despite their potential for higher returns, value stocks come with inherent risks. These include the possibility of value traps, where stocks remain undervalued due to underlying business issues, and market volatility, which can impact short-term performance. Investors should carefully assess these risks before committing capital to value stocks.

Building a Value-Oriented Investment Portfolio

Constructing a value-oriented portfolio involves selecting a diversified mix of value stocks across various sectors and industries. Investors should consider factors such as company size, geographic exposure, and industry trends when building their portfolios. By maintaining a disciplined approach and regularly reviewing their holdings, investors can position themselves for long-term success in the market.

Conclusion

In summary, value stocks present a compelling opportunity for investors seeking to maximize returns while minimizing risks. By understanding the characteristics of value stocks, employing effective strategies, and leveraging resources like 5StarsStocks.com, investors can position themselves for success in the stock market. We encourage you to share your thoughts and experiences with value investing in the comments section below and explore other articles on our site for further insights into the world of investing.

References:

- Dimensional Fund Advisors. (2022). The Value Premium.

- Morningstar. (2021). Value vs. Growth: A Historical Perspective.

- Fama, E. F., & French, K. R. (2021). The Cross-Section of Expected Stock Returns.

Table of Contents

- Understanding Value Stocks

- Why Value Stocks Are a Smart Investment

- Identifying Value Stocks

- Effective Value Investing Strategies

- The Importance of 5StarsStocks.com in Value Investing

- The Historical Performance of Value Stocks

- Dispelling Common Misconceptions About Value Stocks

- Risks Associated with Value Stocks

- Building a Value-Oriented Investment Portfolio

- Conclusion