Gaining a deeper understanding of how credit inquiries influence your credit score is vital for anyone aiming to achieve financial stability and growth. Whether you're applying for a loan, a new credit card, or a mortgage, the impact of these inquiries can significantly shape your financial journey. This article delves into the complexities of credit inquiries, offering actionable advice and expert insights to help you navigate this critical area with confidence.

In today’s financial environment, credit scores play a pivotal role in determining your eligibility for loans, interest rates, and various credit opportunities. One often-overlooked factor that affects credit scores is the presence of credit inquiries. Whether they are hard or soft, these inquiries can have varying effects on your overall financial profile. Understanding how they work can help you manage your credit more effectively.

This article will explore the nuances of credit inquiries, their duration, and provide strategies to minimize their impact. By the end, you will have a clear and comprehensive understanding of how long inquiries affect your credit score and how to manage them wisely.

Read also:Exploring The Fascinating World Of The German Shepherd And English Mastiff Mix

Table of Contents

- What Are Credit Inquiries?

- Types of Credit Inquiries

- How Long Do Inquiries Last?

- Impact of Inquiries on Credit Score

- Hard vs. Soft Inquiries

- Duration of Credit Inquiries

- Strategies to Minimize the Impact

- Common Misconceptions About Credit Inquiries

- Tips for Effective Credit Management

- Conclusion

What Are Credit Inquiries?

Credit inquiries occur whenever a lender or credit issuer reviews your credit report to assess your creditworthiness. These inquiries are logged on your credit report and serve as a record of your financial activity. While inquiries are a routine part of the credit process, understanding their significance is crucial for maintaining a robust credit score.

Why Do Credit Inquiries Matter?

Credit inquiries matter because they provide insight into your financial behavior and decision-making. Lenders and creditors use these inquiries to evaluate how frequently you apply for credit, which can influence their perception of your risk level as a borrower. For instance, frequent applications may signal financial instability, while responsible credit management can enhance your credibility.

Types of Credit Inquiries

Not all credit inquiries are the same. There are two primary types of inquiries: hard inquiries and soft inquiries. Each type has a distinct impact on your credit score and serves a unique purpose.

Hard Inquiries

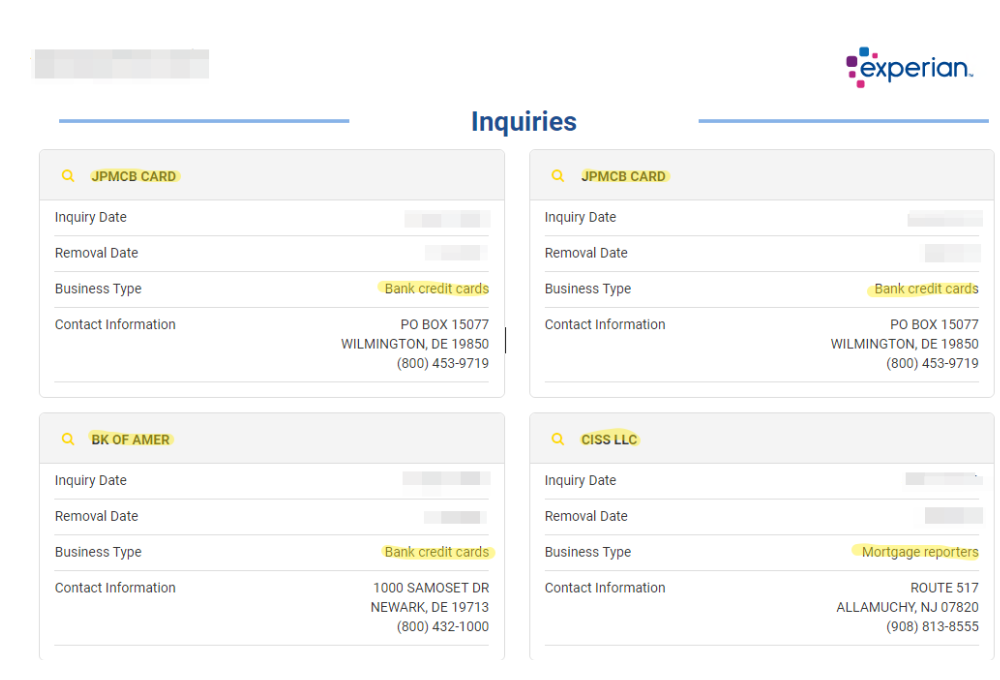

Hard inquiries happen when a lender accesses your credit report during a formal application process, such as applying for a mortgage, car loan, or credit card. These inquiries are recorded on your credit report and can influence your credit score. Hard inquiries are typically triggered by significant financial decisions and reflect your borrowing activity.

Soft Inquiries

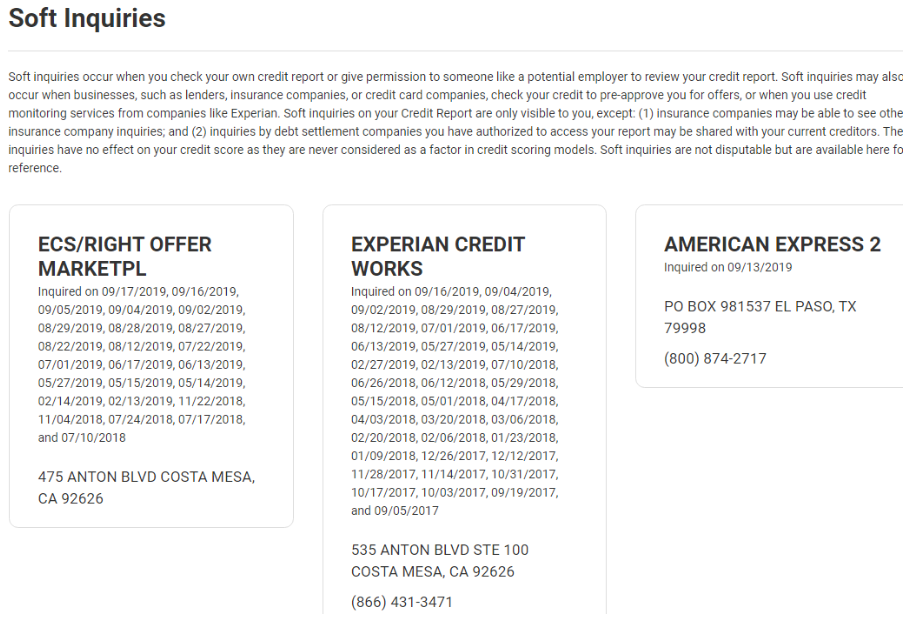

Soft inquiries occur when you review your own credit report or when a lender checks your credit as part of a pre-approval process. Unlike hard inquiries, soft inquiries do not impact your credit score and are only visible to you. They are generally harmless and occur without affecting your financial standing.

How Long Do Inquiries Last?

Credit inquiries typically remain on your credit report for two years. However, their influence on your credit score diminishes over time. Most credit scoring models only consider inquiries from the past 12 months when calculating your score. This fading impact allows you to recover from temporary dips in your credit score caused by new inquiries.

Read also:Exploring The Phenomenon Of Masa49 Videos A Comprehensive Guide

Factors That Influence Inquiry Duration

- Type of Inquiry: Hard inquiries remain visible for two years and affect your score, while soft inquiries do not impact your score and are only visible to you.

- Credit Scoring Model: Different models, such as FICO or VantageScore, may treat inquiries differently, so it’s important to understand the specifics of the model used by your lender.

- Overall Credit History: A strong credit history can help mitigate the impact of inquiries, as lenders consider the bigger picture of your financial behavior.

Impact of Inquiries on Credit Score

The effect of inquiries on your credit score depends on several factors, including the number of inquiries, your credit history, and the type of credit product you’re applying for. On average, a single hard inquiry can lower your credit score by up to five points. While the impact may seem small, multiple inquiries can add up and lead to more significant score reductions.

How Credit Scoring Models Handle Inquiries

Credit scoring models, such as FICO and VantageScore, treat inquiries differently. For example, FICO groups multiple inquiries for the same type of credit, like auto loans or mortgages, within a 14-day window as a single inquiry. This "rate shopping" approach minimizes the impact of multiple inquiries on your score, allowing you to compare offers without excessive damage to your credit.

Hard vs. Soft Inquiries

Understanding the distinction between hard and soft inquiries is essential for managing your credit score effectively. Each type serves a unique purpose and has different implications for your financial health.

Key Differences

- Hard Inquiries: These inquiries affect your credit score and remain on your credit report for two years. They are triggered by formal credit applications and reflect your borrowing activity.

- Soft Inquiries: These inquiries do not affect your credit score and are only visible to you. They occur when you check your own credit report or when lenders review your credit for pre-approval purposes.

Duration of Credit Inquiries

Credit inquiries remain on your credit report for two years, but their impact on your credit score typically fades after 12 months. During this period, it’s important to monitor your credit activity and avoid excessive applications for credit. Managing your inquiries wisely can help you maintain a healthy credit score over time.

How to Track Credit Inquiries

To monitor inquiries on your credit report, you can request a free annual credit report from each of the three major credit bureaus: Experian, Equifax, and TransUnion. Regularly reviewing your credit report not only keeps you informed about your financial health but also helps you detect any unauthorized inquiries that could harm your credit.

Strategies to Minimize the Impact

While inquiries are an inevitable part of the credit process, there are steps you can take to minimize their impact on your credit score. By adopting smart strategies, you can protect your credit score and maintain financial stability.

Best Practices

- Limit Applications: Avoid submitting multiple credit applications within a short period. Space out your applications to reduce the cumulative impact of inquiries.

- Use Rate Shopping Windows: Take advantage of the "rate shopping" window by comparing loan or credit card offers within a 14-day period. This ensures that multiple inquiries are treated as a single event by credit scoring models.

- Review Your Credit Report: Regularly check your credit report for errors or unauthorized inquiries. Addressing these issues promptly can help maintain the accuracy of your credit profile.

Common Misconceptions About Credit Inquiries

There are several misconceptions surrounding credit inquiries that can lead to confusion and poor financial decisions. Understanding the truth behind these myths is essential for making informed choices about your credit.

Myth vs. Reality

- Myth: All inquiries lower your credit score.

Reality: Only hard inquiries affect your credit score. Soft inquiries, such as checking your own credit, have no impact. - Myth: Checking your own credit report harms your score.

Reality: Soft inquiries, including personal reviews of your credit report, do not influence your credit score.

Tips for Effective Credit Management

Managing your credit effectively requires a proactive approach. Here are some actionable tips to help you maintain a healthy credit score and achieve long-term financial success.

Actionable Steps

- Pay on Time: Consistently paying your bills on time is one of the most effective ways to build a strong credit history and improve your credit score.

- Monitor Credit Utilization: Keep your credit utilization ratio below 30% to demonstrate responsible credit management and enhance your score.

- Maintain Old Accounts: Avoid closing old credit accounts, as they contribute to the length of your credit history and can positively impact your score.

Conclusion

In conclusion, understanding how long inquiries impact your credit score is essential for maintaining financial health. While inquiries remain on your credit report for two years, their influence diminishes over time. By implementing smart credit management strategies and staying informed about your credit activity, you can minimize the impact of inquiries and achieve long-term financial success.

We invite you to share your thoughts and experiences in the comments below. Additionally, feel free to explore other articles on our site for more insights into personal finance and credit management. Together, let’s build a brighter financial future!

For further reading, consider these trusted sources: